NEW YORK, May 12, 2025 (GLOBE NEWSWIRE) -- Resolute Holdings Management, Inc. (“Resolute Holdings”) (Nasdaq: RHLD), an operating management company responsible for providing management services to CompoSecure Holdings, L.L.C. (“CompoSecure Holdings”), a wholly owned subsidiary of CompoSecure, Inc. (“CompoSecure”) (Nasdaq: CMPO), today reported financial results for its fiscal first quarter ending March 31, 2025. Resolute Holdings reported first quarter earnings per share attributable to common stockholders of ($0.39) and Non-GAAP Fee-Related Earnings per share of ($0.07).

“The first quarter was foundational for Resolute Holdings, with the spin-off from CompoSecure completed in February. We experienced a higher than normal tax provision and post spin-off professional fees in the quarter but reiterate our expectation for limited profitability for the full year with approximately $3.0mm of quarterly management fee revenue. I am pleased with the team we have assembled and believe our unique combination of permanent capital and differentiated operating capabilities position us well for the future,” said Tom Knott, Resolute Holdings’ Chief Executive Officer.

Dave Cote, Resolute Holdings’ Executive Chairman added “We are encouraged by the ongoing work to improve operations, drive organic growth, and build a high-performance culture at CompoSecure. In the first quarter, we also increased our efforts to evaluate potential acquisitions and anticipate those efforts to remain significant through 2025 and beyond. We are pleased with our start to the year and remain focused on supporting CompoSecure while rigorously evaluating potential acquisitions that meet our core investment criteria.”

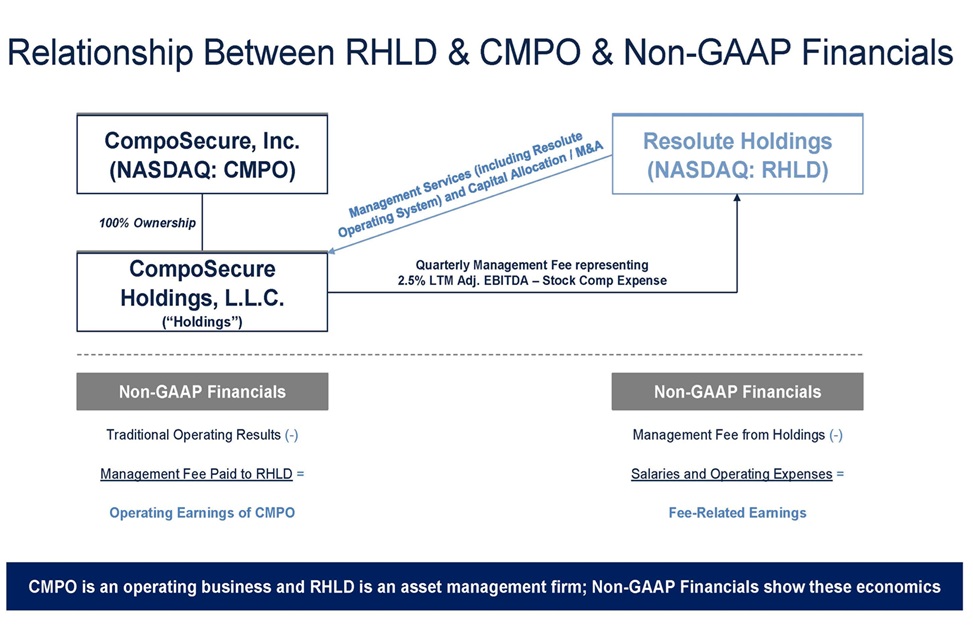

As a result of the spin-off from CompoSecure and execution of the Management Agreement with CompoSecure Holdings, Resolute Holdings is required to consolidate the financial results of CompoSecure Holdings in accordance with U.S. GAAP. This presentation of financial results does not represent the underlying economics or the positive attributes of Resolute Holdings’ standalone business model, which consist of recurring, long-duration management fees and a relatively fixed expense base. The results of the Resolute Holdings standalone business and associated Non-GAAP Fee-Related Earnings calculation are included below to provide a clear picture of the economic performance of the business directly attributable to shareholders of RHLD. This release includes such results presented in accordance with U.S. GAAP, as well as certain Non-GAAP measures, including Fee-Related Earnings. See “Use of Non-GAAP Financial Measures” below.

| Resolute Holdings Segment Financial Information (GAAP); Fee-Related Earnings and Fee-Related Earnings Per Share (Non-GAAP) ($ in thousands except per share figures) | ||||

| Three months | ||||

| ended | ||||

| March, 31 2025 | ||||

| Management fees | $ | 1,129 | ||

| Selling, general and administrative expenses | 3,926 | |||

| Income from operations | (2,797 | ) | ||

| Total other income (expense) | (1 | ) | ||

| Income (loss) before income taxes | (2,798 | ) | ||

| Income tax (expense) | (568 | ) | ||

| Net income (loss) | (3,366 | ) | ||

| Net income (loss) attributable to non-controlling interest | — | |||

| Net income (loss) attributable to common stockholders | (3,366 | ) | ||

| Net income (loss) per share attributable to common stockholders - diluted | $ | (0.39 | ) | |

| Adjustments to reconcile Fee-Related Earnings to net income (loss) attributable to common stockholders: | ||||

| Add: Equity-based compensation at CompoSecure (1) | 1,148 | |||

| Add: Pro forma management fees from Jan 1, 2025 to Feb 27, 2025 (2) | 2,046 | |||

| Add: Spin-Off costs (3) | 290 | |||

| Net tax impact of adjustments (4) | (724 | ) | ||

| Fee-Related Earnings | (606 | ) | ||

| Fee-Related Earnings per share - diluted | $ | (0.07 | ) | |

| (1) Equity-based compensation required to be reported by Resolute Holdings related to awards issued under the CompoSecure Equity Plan. Equity granted under the CompoSecure Equity Plan relates to CompoSecure Class A common stock and has no impact on Resolute Holdings’ common stock outstanding. (2) Incremental management fees as if the CompoSecure Management Agreement was executed on January 1, 2025. (3) One-time costs associated with the Spin-Off from CompoSecure. (4) Tax-effect of adjustments at a 31% effective tax rate. Only applied to those adjustments that would impact Resolute Holdings’ taxes. Equity-based compensation expense under the CompoSecure Equity Plan is expensed for tax purposes at CompoSecure and not Resolute Holdings. | ||||

Exhibit – Structural Relationship & Non-GAAP Financial Summary

About Resolute Holdings Management, Inc.

Resolute Holdings (Nasdaq: RHLD) is an alternative asset management platform led by David Cote and Tom Knott that provides operating management services including the oversight of capital allocation strategy, operational practices, and M&A sourcing and execution at CompoSecure Holdings and other managed businesses in the future. Resolute Holdings brings a differentiated approach to long-term value creation through the systematic deployment of the Resolute Operating System, which will create value at both the underlying managed businesses and at Resolute Holdings. For additional information on Resolute Holdings, please refer to Resolute Holdings’ filings with the U.S. Securities and Exchange Commission or please visit www.resoluteholdings.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although Resolute Holdings believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, Resolute Holdings cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning Resolute Holdings’ expectations regarding personnel, future platform acquisitions, limited profitability for the year ending December 31, 2025, revenues from management fees, the deployment of the Resolute Operating System, market opportunities, possible or assumed future actions, business strategies, events, or results of operations, and other matters, are forward-looking statements. In some instances, these statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect Resolute Holdings’ future results and could cause those results or other outcomes to differ materially from those expressed or implied in Resolute Holdings’ forward-looking statements: the timing and amount of the management fees payable to Resolute Holdings, including unexpected fluctuations therein, unexpected changes in costs, risks associated with the implementation of the Resolute Operating System, unexpected market and macroeconomic developments, demand for Resolute Holdings’ services, the ability of Resolute Holdings to grow and manage growth profitably, compete within its industry and attract and retain its key employees; the possibility that Resolute Holdings may be adversely impacted by other global economic, business, competitive and/or other factors, including but not limited to inflationary pressures, volatile interest rates, variable tariff policies or intensified disruptions in the global financial markets; the outcome of any legal proceedings that may be instituted against Resolute Holdings or others; future exchange and interest rates; and other risks and uncertainties, including those under “Risk Factors” in filings that have been made or will be made with the Securities and Exchange Commission. Resolute Holdings undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. Resolute Holdings believes Fee-Related Earnings and Fee-Related Earnings per share are useful to investors in evaluating Resolute Holdings’ financial performance. Resolute Holdings believes that these non-GAAP financial measures depict the performance of the business and underlying economics attributable to Resolute Holdings common stockholders. Fee-Related Earnings and Fee-Related Earnings per share should not be considered as measures of financial performance under U.S. GAAP, and the items excluded from Fee-Related Earnings and Fee-Related Earnings per share are significant components in understanding and assessing Resolute Holdings’ financial performance. Accordingly, these key business metrics have limitations as an analytical tool. They should not be considered as an alternative to net income, net income per share, or any other performance measures derived in accordance with U.S. GAAP and may be different from similarly titled non-GAAP measures used by other companies.

For investor inquiries, please contact:

Resolute Holdings

(212) 256-8405

info@resoluteholdings.com

| Consolidated Balance Sheets Resolute Holdings Management, Inc. ($ in thousands, except par value and share amounts) | ||||||||

| March 31, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Unaudited | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 71,017 | $ | 71,589 | ||||

| Accounts receivable | 54,188 | 47,449 | ||||||

| Inventories, net | 47,501 | 44,833 | ||||||

| Prepaid expenses and other current assets | 3,450 | 2,696 | ||||||

| Deferred tax asset | 24 | 24 | ||||||

| Total current assets | 176,180 | 166,591 | ||||||

| Property and equipment, net | 21,917 | 23,448 | ||||||

| Right of use assets, net | 10,238 | 5,404 | ||||||

| Derivative asset - interest rate swap | 1,996 | 2,749 | ||||||

| Deposits and other assets | 3,957 | 3,600 | ||||||

| Total assets | $ | 214,288 | $ | 201,792 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 11,414 | $ | 5,691 | ||||

| Accrued expenses | 16,196 | 20,062 | ||||||

| Bonus payable | 4,199 | 8,466 | ||||||

| Commission payable | 2,400 | 2,563 | ||||||

| Current portion of long-term debt | 12,500 | 11,250 | ||||||

| Current portion of lease liabilities – operating leases | 2,110 | 2,113 | ||||||

| Total current liabilities | 48,819 | 50,145 | ||||||

| Long-term debt, net of deferred financing costs | 180,713 | 184,389 | ||||||

| Lease liabilities, operating leases | 8,762 | 3,888 | ||||||

| Total liabilities | 238,294 | 238,422 | ||||||

| Commitments and contingencies (Note 16) | — | — | ||||||

| Preferred stock, $0.0001 par value; 100,000,000 shares authorized, 0 shares issued and outstanding | — | — | ||||||

| Common stock, $0.0001 par value; 1,000,000,000 shares authorized, 8,525,998 and 0 shares issued and outstanding as of March 31, 2025 and December 31, 2024, respectively. | — | — | ||||||

| Additional paid-in capital | 14,569 | 1,544 | ||||||

| Accumulated deficit | (5,700 | ) | (2,334 | ) | ||||

| Total stockholders' equity (deficit) | 8,869 | (790 | ) | |||||

| Non-controlling interest | (32,875 | ) | (35,840 | ) | ||||

| Total equity (deficit) | (24,006 | ) | (36,630 | ) | ||||

| Total liabilities and stockholders' equity (deficit) | $ | 214,288 | $ | 201,792 | ||||

| Consolidated Statements of Operations Resolute Holdings Management, Inc. ($ in thousands, except per share amounts) | ||||||||

| Three months ended | ||||||||

| March 31, | ||||||||

| 2025 | 2024 | |||||||

| Net sales | $ | 103,889 | $ | 104,010 | ||||

| Cost of sales | 49,342 | 48,797 | ||||||

| Gross profit | 54,547 | 55,213 | ||||||

| Operating expenses: | ||||||||

| Selling, general and administrative expenses | 28,926 | 22,770 | ||||||

| Income from operations | 25,621 | 32,443 | ||||||

| Other income (expense): | ||||||||

| Change in fair value of derivative liability - convertible notes redemption make-whole provision | — | (297 | ) | |||||

| Interest income | 1,077 | 1,104 | ||||||

| Interest expense | (3,384 | ) | (6,537 | ) | ||||

| Amortization of deferred financing costs | (131 | ) | (327 | ) | ||||

| Total other expense, net | (2,438 | ) | (6,057 | ) | ||||

| Income (loss) before income taxes | 23,183 | 26,386 | ||||||

| Income tax (expense) | (568 | ) | — | |||||

| Net income (loss) | $ | 22,615 | $ | 26,386 | ||||

| Net income (loss) attributable to non-controlling interest | 25,981 | 26,386 | ||||||

| Net income (loss) attributable to common stockholders | $ | (3,366 | ) | $ | — | |||

| Net income (loss) per share attributable to common stockholders - basic & diluted | $ | (0.39 | ) | $ | — | |||

| Weighted average shares used to compute net income (loss) per share attributable to common stockholders - basic & diluted (in thousands) | 8,526 | 8,526 | ||||||

| Consolidated Statements of Cash Flows Resolute Holdings Management, Inc. ($ in thousands) | ||||||||

| Three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income (loss) | $ | 22,615 | $ | 26,386 | ||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 2,273 | 2,221 | ||||||

| Equity-based compensation expense | 6,046 | 4,167 | ||||||

| Amortization of deferred financing costs | 131 | 345 | ||||||

| Non-cash operating lease expense | 615 | 587 | ||||||

| Change in fair value of derivative liability – convertible notes redemption make-whole provisions | — | 297 | ||||||

| Changes in assets and liabilities | ||||||||

| Accounts receivable | (6,739 | ) | 5,378 | |||||

| Inventories | (2,668 | ) | (2,657 | ) | ||||

| Prepaid expenses and other assets | (754 | ) | 654 | |||||

| Accounts payable | 5,723 | (369 | ) | |||||

| Accrued expenses | (3,866 | ) | 460 | |||||

| Lease liabilities | (578 | ) | (603 | ) | ||||

| Other liabilities | (4,430 | ) | (1,198 | ) | ||||

| Net cash provided by operating activities | 18,368 | 35,668 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchase of property and equipment | (576 | ) | (1,613 | ) | ||||

| Capitalized software costs | (580 | ) | — | |||||

| Net cash used in investing activities | (1,156 | ) | (1,613 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Payment of term loan | (2,500 | ) | (4,688 | ) | ||||

| Distributions to CompoSecure Holdings members | — | (13,422 | ) | |||||

| Contribution by CompoSecure Holdings | 11,869 | — | ||||||

| Contribution to Resolute Holdings | (11,869 | ) | — | |||||

| Payments for taxes related to net share settlement of CompoSecure equity awards | (15,284 | ) | (3,426 | ) | ||||

| Transfer to CompoSecure | — | (442 | ) | |||||

| Net cash used in financing activities | (17,784 | ) | (21,978 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | (572 | ) | 12,077 | |||||

| Cash and cash equivalents, beginning of period | 71,589 | 38,191 | ||||||

| Cash and cash equivalents, end of period | $ | 71,017 | $ | 50,268 | ||||

| Supplementary disclosure of cash flow information: | ||||||||

| Cash paid for interest expense | $ | 3,299 | $ | 4,175 | ||||

| Supplemental disclosure of non-cash financing activities: | ||||||||

| Consolidation of CompoSecure Holdings net assets (liabilities), excluding cash, from execution of CompoSecure Management Agreement | $ | (98,508 | ) | $ | — | |||

| Derivative asset - interest rate swap | $ | (753 | ) | $ | 487 | |||

| Segment Statements of Operations and Non-GAAP Reconciliations Resolute Holdings Management, Inc. ($ in thousands, except per share amounts) | ||||||||||||||||

| Three months ended | ||||||||||||||||

| March 31, 2025 | ||||||||||||||||

| ($ in thousands except per share figures) | ||||||||||||||||

| Resolute | CompoSecure | Intercompany/ | ||||||||||||||

| Holdings | Holdings | Eliminations | Consolidated | |||||||||||||

| Management fees | $ | 1,129 | $ | — | $ | (1,129 | ) | $ | — | |||||||

| Product sales | — | 103,889 | — | 103,889 | ||||||||||||

| Net sales | 1,129 | 103,889 | (1,129 | ) | 103,889 | |||||||||||

| Cost of sales | — | 49,342 | — | 49,342 | ||||||||||||

| Gross profit | 1,129 | 54,547 | (1,129 | ) | 54,547 | |||||||||||

| Total selling, general and administrative expenses | 3,926 | 27,939 | (2,939 | ) | 28,926 | |||||||||||

| Income from operations | (2,797 | ) | 26,608 | 1,810 | 25,621 | |||||||||||

| Total other income (expense) | (1 | ) | (2,437 | ) | — | (2,438 | ) | |||||||||

| Income (loss) before income taxes | (2,798 | ) | 24,171 | 1,810 | 23,183 | |||||||||||

| Income tax (expense) | (568 | ) | — | — | (568 | ) | ||||||||||

| Net income (loss) | (3,366 | ) | 24,171 | 1,810 | 22,615 | |||||||||||

| Net income (loss) attributable to non-controlling interest | — | 24,171 | 1,810 | 25,981 | ||||||||||||

| Net income (loss) attributable to common stockholders | (3,366 | ) | — | — | (3,366 | ) | ||||||||||

| Net income (loss) per share attributable to common stockholders - diluted | $ | (0.39 | ) | $ | (0.39 | ) | ||||||||||

| Adjustments to reconcile fee-related earnings to net income (loss) attributable to common stockholders: | ||||||||||||||||

| Add: Equity-based compensation at CompoSecure (1) | 1,148 | 1,148 | ||||||||||||||

| Add: Pro forma management fees from Jan 1, 2025 to Feb 27, 2025 (2) | 2,046 | 2,046 | ||||||||||||||

| Add: Spin-Off costs (3) | 290 | 290 | ||||||||||||||

| Net tax impact of adjustments (4) | (724 | ) | (724 | ) | ||||||||||||

| Fee-Related Earnings | (606 | ) | (606 | ) | ||||||||||||

| Fee-Related Earnings per share - diluted | $ | (0.07 | ) | $ | (0.07 | ) | ||||||||||

| Weighted average shares used to compute net income (loss) per share attributable to common stockholders and Fee-Related Earnings per share - diluted (in thousands) | 8,526 | 8,526 | ||||||||||||||

| (1) Equity-based compensation required to be reported by Resolute Holdings related to awards issued under the CompoSecure Equity Plan. Equity granted under the CompoSecure Equity Plan relates to CompoSecure Class A common stock and has no impact on Resolute Holdings’ common stock outstanding. (2) Incremental management fees as if the CompoSecure Management Agreement was executed on January 1, 2025. (3) One-time costs associated with the Spin-Off from CompoSecure. (4) Tax-effect of adjustments at a 31% effective tax rate. Only applied to those adjustments that would impact Resolute Holdings’ taxes. Equity-based compensation expense under the CompoSecure Equity Plan is expensed for tax purposes at CompoSecure and not Resolute Holdings. | ||||||||||||||||

| Additional Information Segment Balance Sheets Resolute Holdings Management, Inc. ($ in thousands, except per share amounts) | ||||||||||||||||

| March 31, 2025 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||

| Resolute | CompoSecure | Intercompany/ | ||||||||||||||

| Holdings | Holdings | Eliminations | Consolidated | |||||||||||||

| ASSETS | ||||||||||||||||

| CURRENT ASSETS | ||||||||||||||||

| Cash and cash equivalents | $ | 8,847 | $ | 62,170 | $ | — | $ | 71,017 | ||||||||

| Accounts receivable | 1,129 | 54,188 | (1,129 | ) | 54,188 | |||||||||||

| Inventories, net | — | 47,501 | — | 47,501 | ||||||||||||

| Prepaid expenses and other current assets | 632 | 2,818 | — | 3,450 | ||||||||||||

| Deferred tax asset | 24 | — | — | 24 | ||||||||||||

| Total current assets | 10,632 | 166,677 | (1,129 | ) | 176,180 | |||||||||||

| Property and equipment, net | — | 21,917 | — | 21,917 | ||||||||||||

| Right of use assets, net | 1,110 | 9,128 | — | 10,238 | ||||||||||||

| Derivative asset - interest rate swap | — | 1,996 | — | 1,996 | ||||||||||||

| Deposits and other assets | — | 3,957 | — | 3,957 | ||||||||||||

| Total assets | 11,742 | 203,675 | (1,129 | ) | 214,288 | |||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||||||||||

| CURRENT LIABILITIES | ||||||||||||||||

| Accounts payable | 112 | 11,236 | 66 | 11,414 | ||||||||||||

| Accrued expenses | 1,651 | 15,674 | (1,129 | ) | 16,196 | |||||||||||

| Bonus payable | — | 4,199 | — | 4,199 | ||||||||||||

| Commission payable | — | 2,400 | — | 2,400 | ||||||||||||

| Current portion of long-term debt | — | 12,500 | — | 12,500 | ||||||||||||

| Current portion of lease liabilities – operating leases | 71 | 2,039 | — | 2,110 | ||||||||||||

| Total current liabilities | 1,834 | 48,048 | (1,063 | ) | 48,819 | |||||||||||

| Long-term debt, net of deferred financing costs | — | 180,713 | — | 180,713 | ||||||||||||

| Lease liabilities, operating leases | 1,039 | 7,723 | — | 8,762 | ||||||||||||

| Total liabilities | 2,873 | 236,484 | (1,063 | ) | 238,294 | |||||||||||

| Additional paid-in capital | 14,569 | — | — | 14,569 | ||||||||||||

| Accumulated deficit | (5,700 | ) | — | — | (5,700 | ) | ||||||||||

| Total stockholders' equity (deficit) | 8,869 | — | — | 8,869 | ||||||||||||

| Non-controlling interest | — | (32,809 | ) | (66 | ) | (32,875 | ) | |||||||||

| Total equity (deficit) | 8,869 | (32,809 | ) | (66 | ) | (24,006 | ) | |||||||||

| Total liabilities and stockholders' equity (deficit) | $ | 11,742 | $ | 203,675 | $ | (1,129 | ) | $ | 214,288 | |||||||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/da9510b4-d572-4307-90a4-25015169fd4d