Let’s dig into the relative performance of Oxford Industries (NYSE:OXM) and its peers as we unravel the now-completed Q2 apparel and accessories earnings season.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was 12.8% below.

In light of this news, share prices of the companies have held steady as they are up 3.9% on average since the latest earnings results.

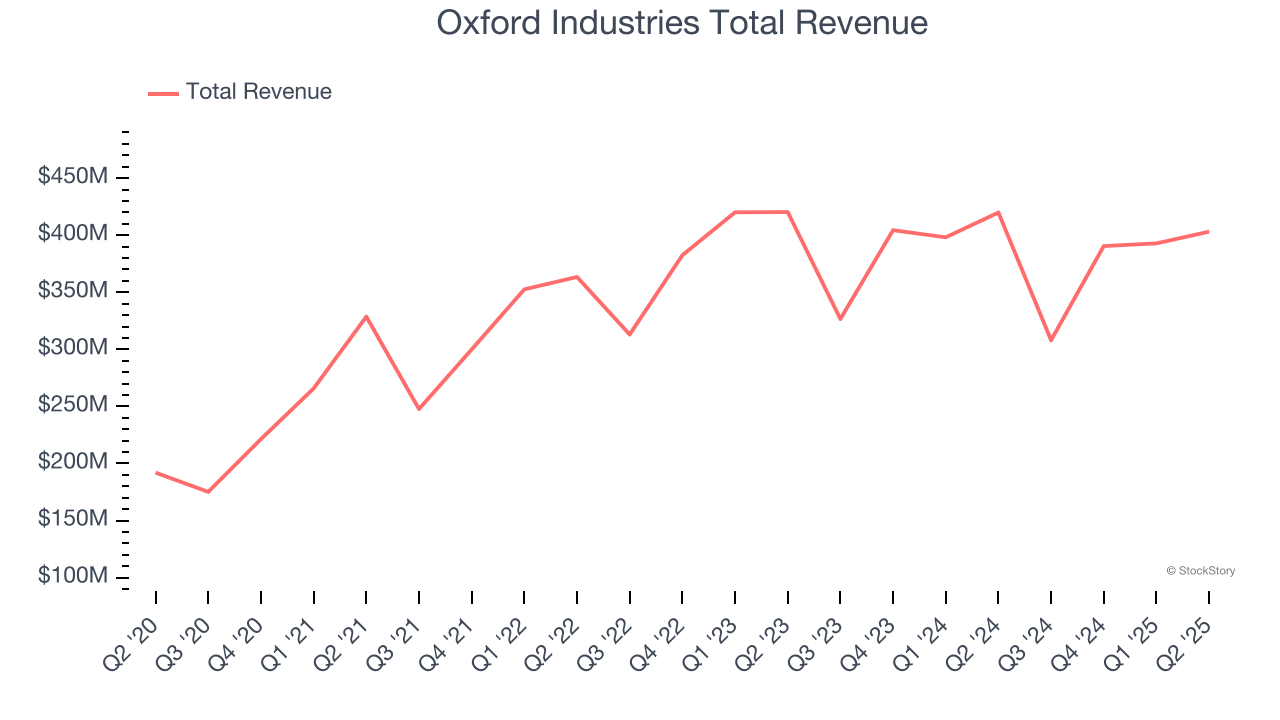

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $403.1 million, down 4% year on year. This print fell short of analysts’ expectations by 0.7%. Overall, it was a mixed quarter for the company with full-year EPS guidance beating analysts’ expectations but EPS guidance for next quarter missing analysts’ expectations significantly.

Tom Chubb, Chairman and CEO, commented, “Our teams executed well in a dynamic trade and tariff environment, delivering sales within our guidance range and an adjusted EPS above our guidance range for the second quarter driven by better-than-expected gross margins. We have moved quickly to diversify our sourcing as well as to pull some inventory receipts forward and calibrate pricing with care to help partially offset the impact on product costs from the incremental tariffs and evolving trade environment that has emerged this year. The results of our efforts allowed us to continue to offer the product assortment our customer expects from our brands while maintaining our strong margin profile."

Oxford Industries delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 6.1% since reporting and currently trades at $37.97.

Read our full report on Oxford Industries here, it’s free for active Edge members.

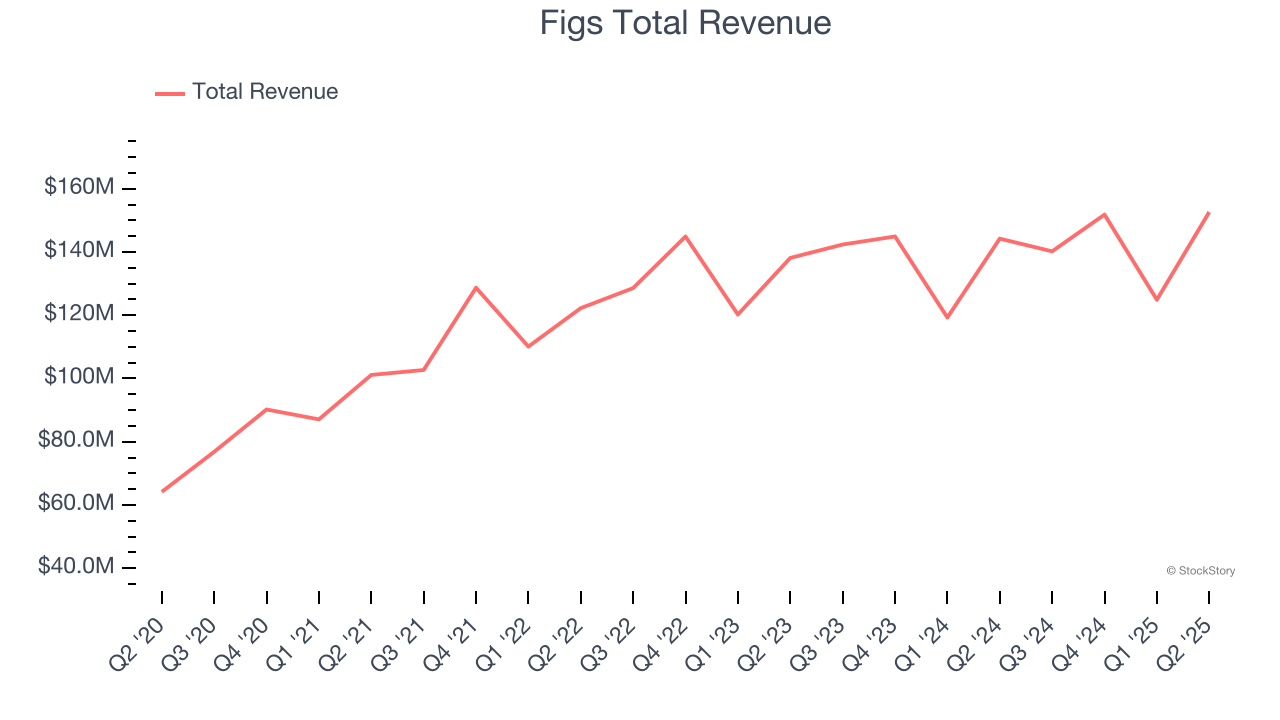

Best Q2: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $152.6 million, up 5.8% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a beat of analysts’ EPS estimates and EBITDA estimates.

The market seems happy with the results as the stock is up 22% since reporting. It currently trades at $8.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Carter's (NYSE:CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $585.3 million, up 3.7% year on year, exceeding analysts’ expectations by 3.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 9.3% since the results and currently trades at $29.69.

Read our full analysis of Carter’s results here.

Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $161.8 million, up 3.1% year on year. This result topped analysts’ expectations by 3.2%. However, it was a slower quarter as it recorded a significant miss of analysts’ EPS estimates.

The stock is up 2% since reporting and currently trades at $17.87.

Read our full, actionable report on Movado here, it’s free for active Edge members.

PVH (NYSE:PVH)

Founded in 1881 by a husband and wife duo, PVH (NYSE:PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

PVH reported revenues of $2.17 billion, up 4.5% year on year. This number beat analysts’ expectations by 2.3%. It was a strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $81.84.

Read our full, actionable report on PVH here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.