Networking technology giant Cisco (NASDAQ:CSCO) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 7.5% year on year to $14.88 billion. Guidance for next quarter’s revenue was optimistic at $15.1 billion at the midpoint, 3% above analysts’ estimates. Its non-GAAP profit of $1 per share was 1.9% above analysts’ consensus estimates.

Is now the time to buy Cisco? Find out by accessing our full research report, it’s free for active Edge members.

Cisco (CSCO) Q3 CY2025 Highlights:

- Revenue: $14.88 billion vs analyst estimates of $14.76 billion (7.5% year-on-year growth, 0.8% beat)

- Adjusted EPS: $1 vs analyst estimates of $0.98 (1.9% beat)

- Adjusted EBITDA: $5.02 billion vs analyst estimates of $5.58 billion (33.8% margin, 10% miss)

- The company lifted its revenue guidance for the full year to $60.6 billion at the midpoint from $59.5 billion, a 1.8% increase

- Management raised its full-year Adjusted EPS guidance to $4.11 at the midpoint, a 2% increase

- Operating Margin: 22.6%, up from 17% in the same quarter last year

- Free Cash Flow Margin: 19.4%, down from 24.9% in the same quarter last year

- Market Capitalization: $282.6 billion

"We had a solid start to fiscal 2026, and Cisco is on track to deliver our strongest year yet," said Chuck Robbins, chair and CEO of Cisco.

Company Overview

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ:CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $57.7 billion in revenue over the past 12 months, Cisco is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For Cisco to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

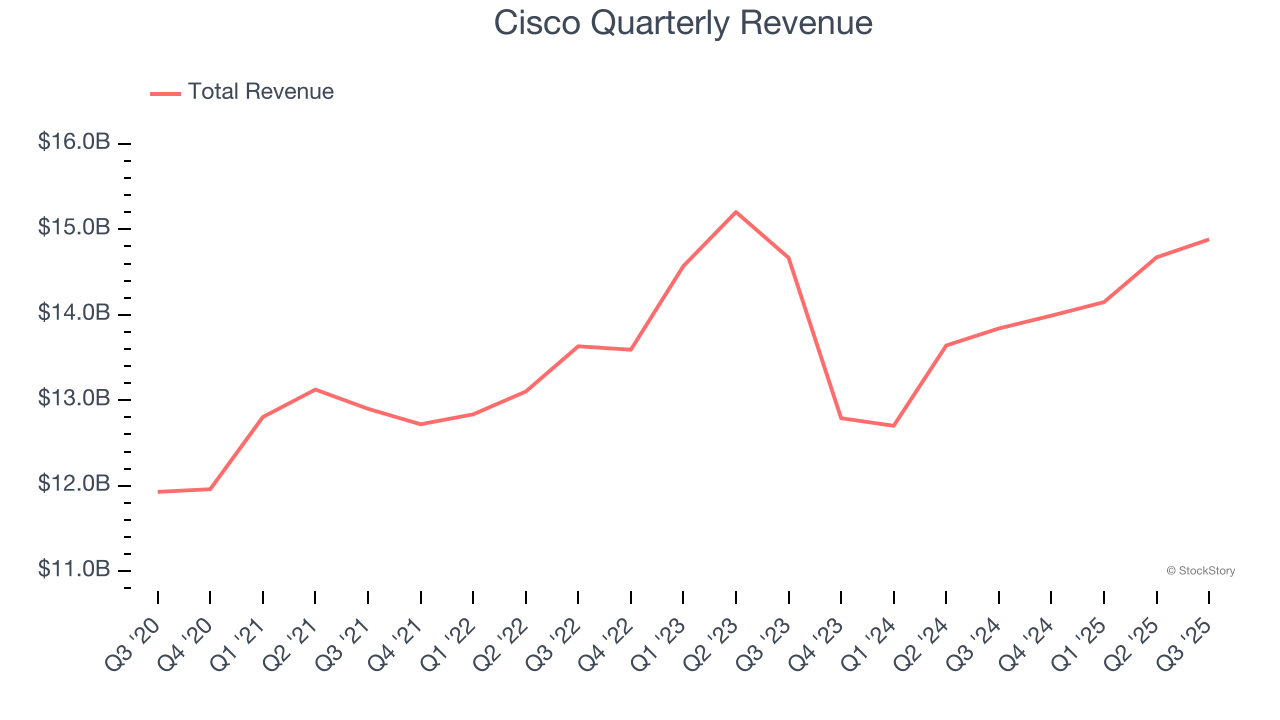

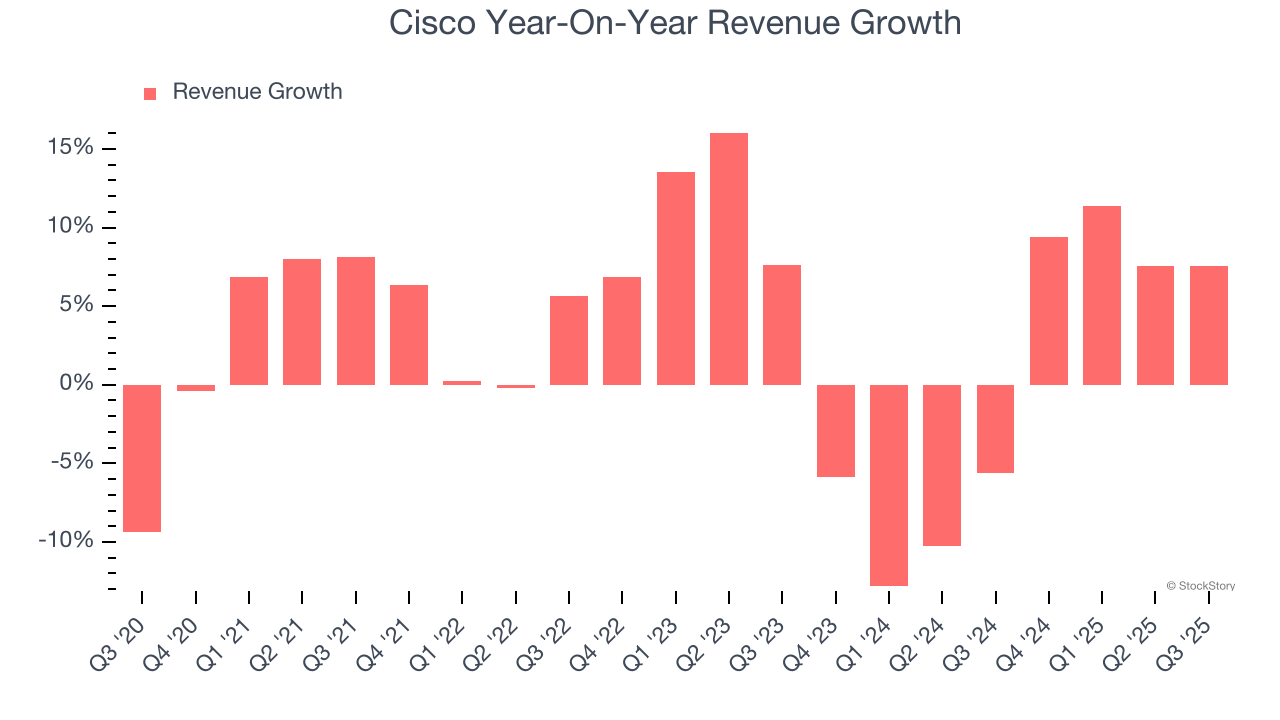

As you can see below, Cisco’s 3.7% annualized revenue growth over the last five years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Cisco’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Cisco reported year-on-year revenue growth of 7.5%, and its $14.88 billion of revenue exceeded Wall Street’s estimates by 0.8%. Company management is currently guiding for a 7.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

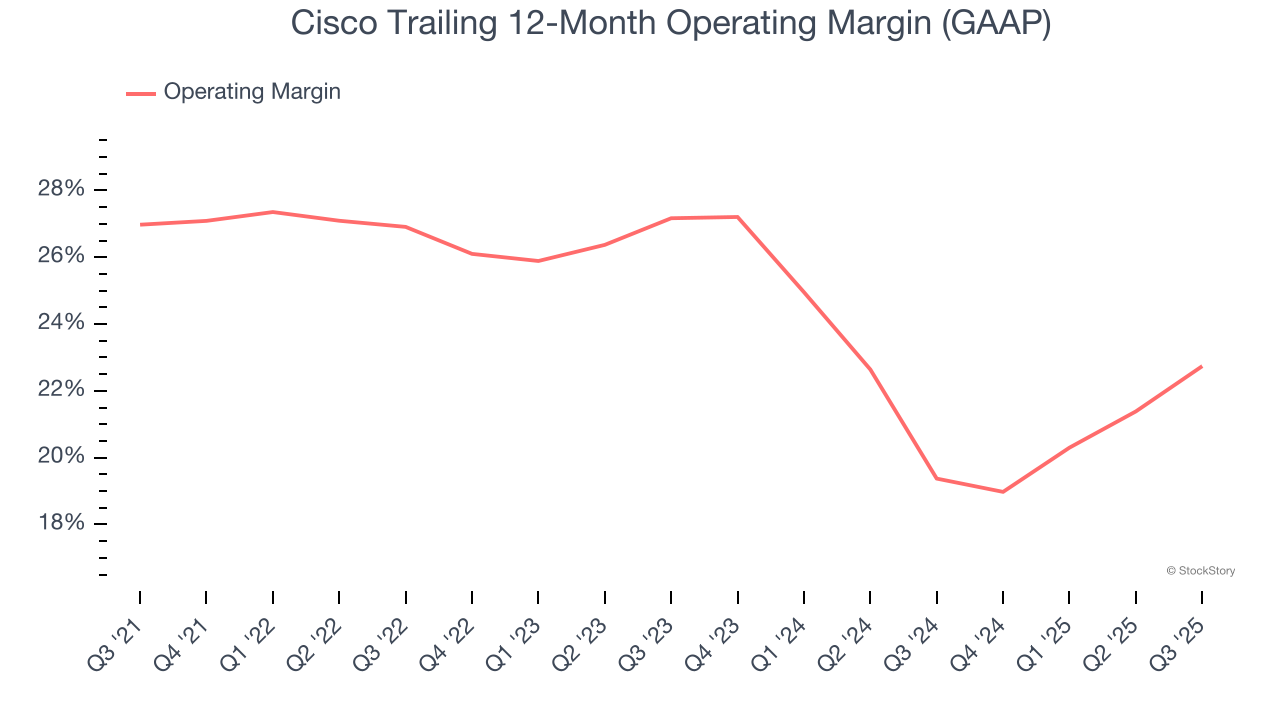

Cisco has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.6%.

Analyzing the trend in its profitability, Cisco’s operating margin decreased by 4.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Cisco generated an operating margin profit margin of 22.6%, up 5.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

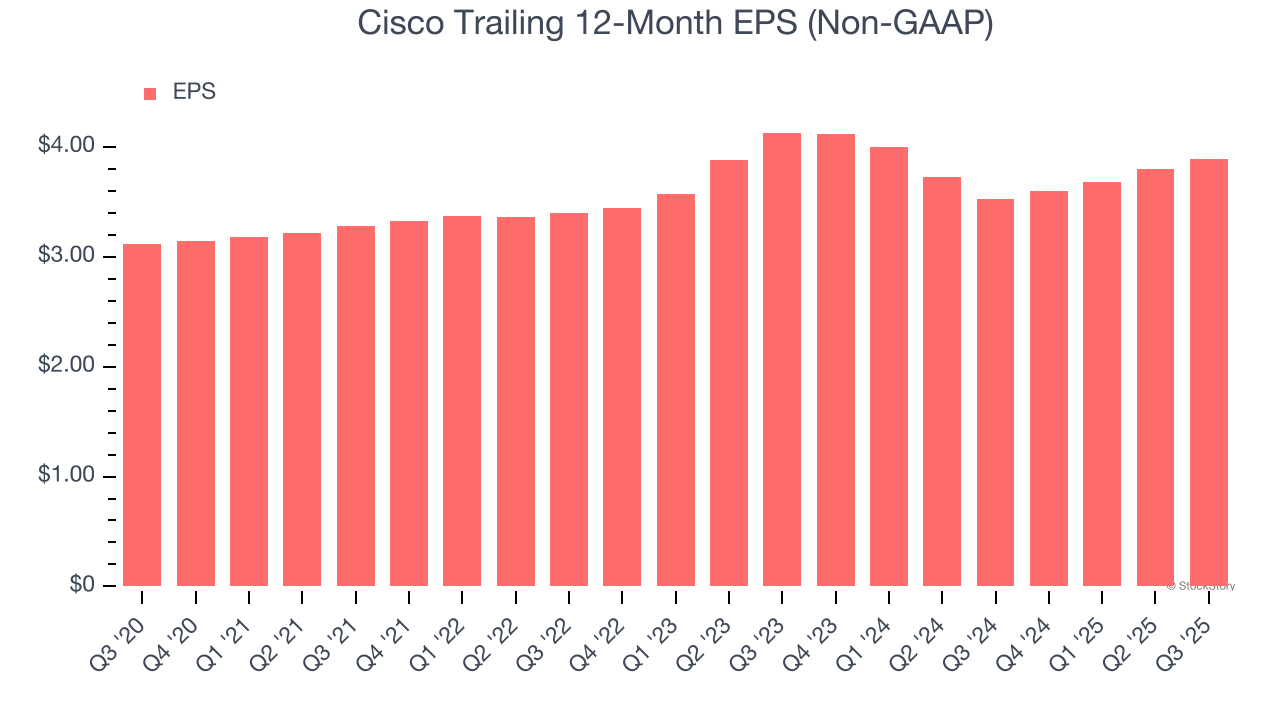

Cisco’s unimpressive 4.5% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Cisco’s two-year annual EPS declines of 2.9% were bad and lower than its flat revenue.

Diving into the nuances of Cisco’s earnings can give us a better understanding of its performance. While we mentioned earlier that Cisco’s operating margin expanded this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Cisco reported adjusted EPS of $1, up from $0.91 in the same quarter last year. This print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Cisco’s full-year EPS of $3.89 to grow 5.9%.

Key Takeaways from Cisco’s Q3 Results

We were impressed by Cisco’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 5% to $77.67 immediately after reporting.

Sure, Cisco had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.