Walgreens has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 22.7% and now trades at $11.12. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Walgreens, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re happy investors have made money, but we're cautious about Walgreens. Here are three reasons why we avoid WBA and a stock we'd rather own.

Why Do We Think Walgreens Will Underperform?

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ:WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

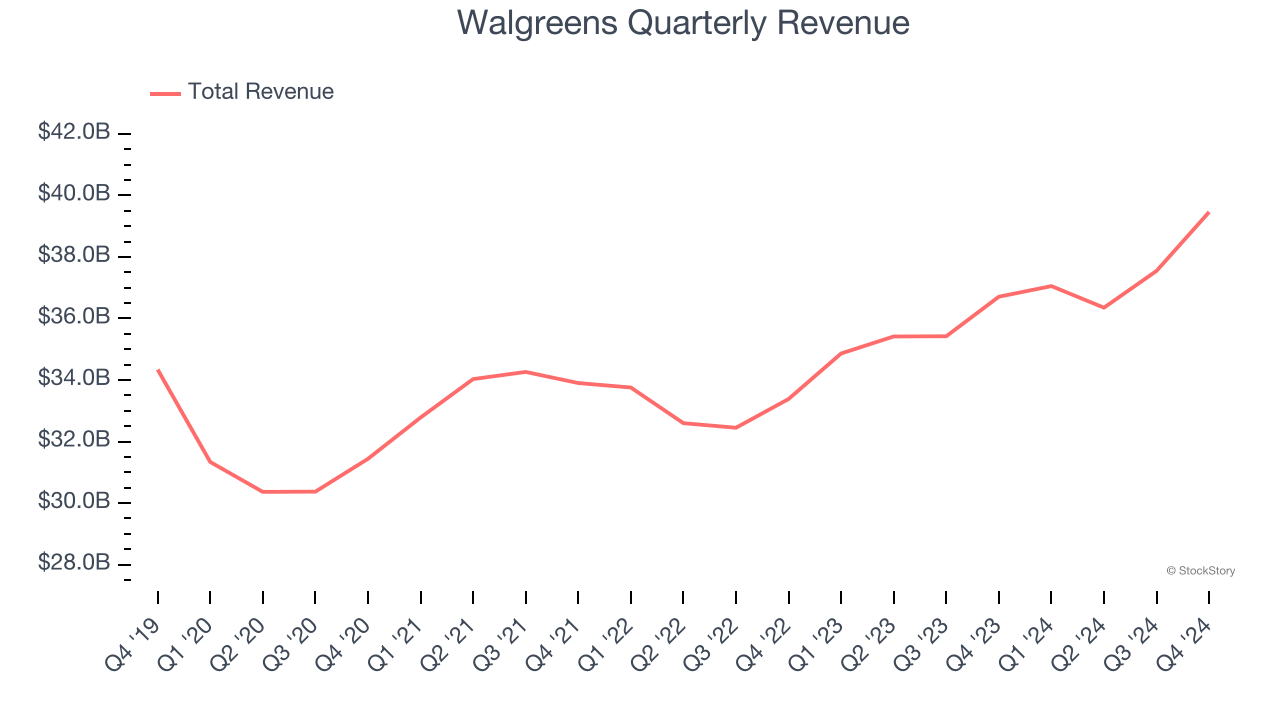

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Walgreens grew its sales at a sluggish 3.8% compounded annual growth rate. This fell short of our benchmark for the consumer retail sector.

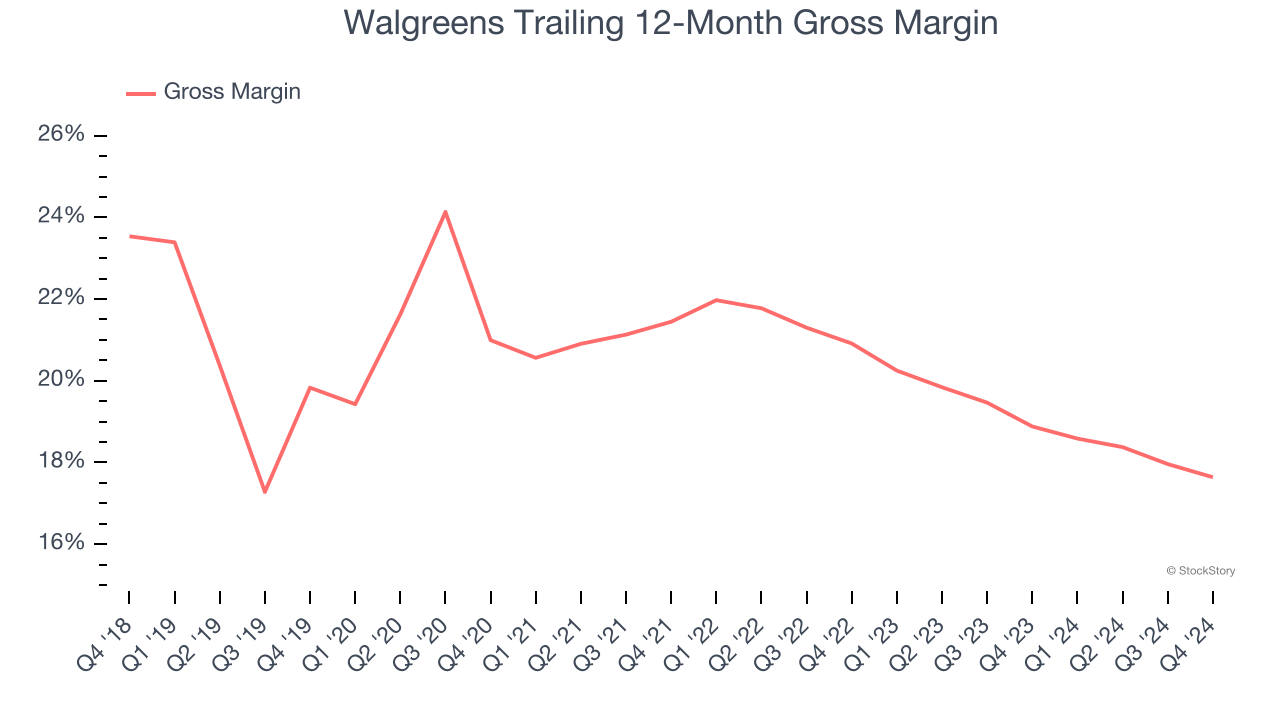

2. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Walgreens has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 18.2% gross margin over the last two years. That means Walgreens paid its suppliers a lot of money ($81.76 for every $100 in revenue) to run its business.

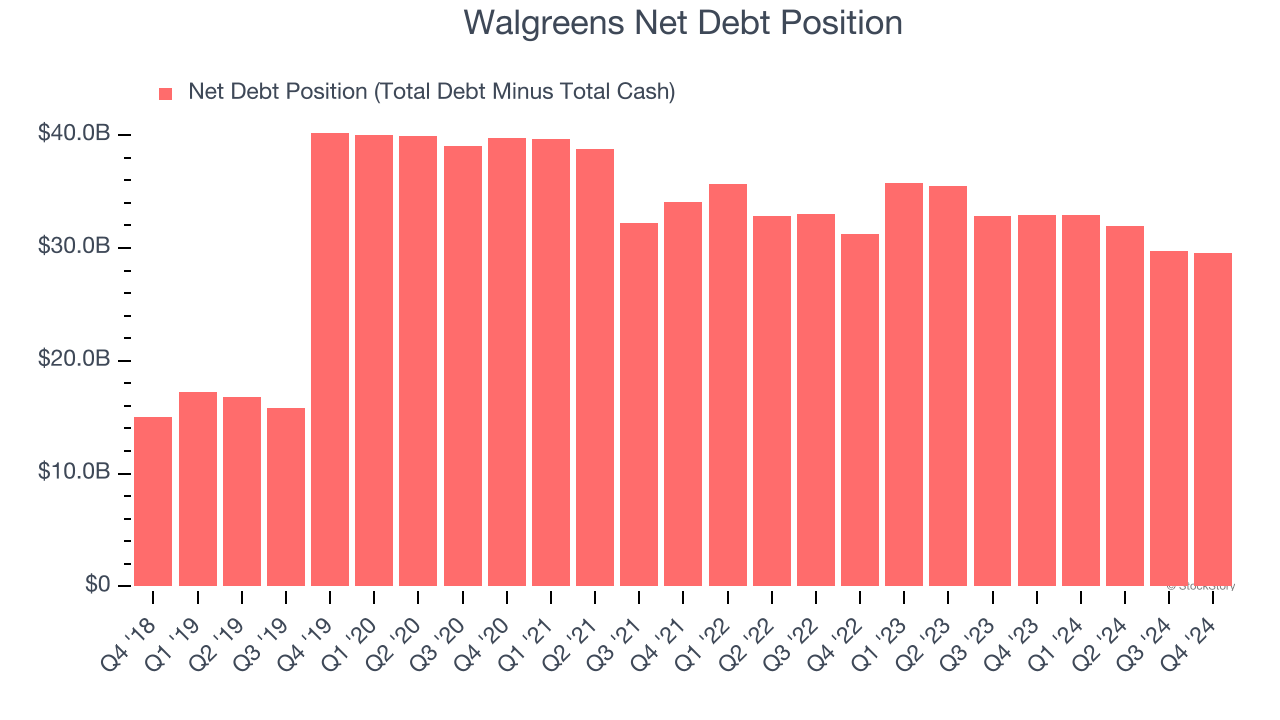

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Walgreens’s $30.71 billion of debt exceeds the $1.19 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $4.63 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Walgreens could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Walgreens can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We see the value of companies helping consumers, but in the case of Walgreens, we’re out. With its shares topping the market in recent months, the stock trades at 7.5× forward price-to-earnings (or $11.12 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Walgreens

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.