Global wind blade manufacturer TPI Composites (NASDAQ:TPIC) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 12.4% year on year to $336.2 million. The company’s full-year revenue guidance of $1.45 billion at the midpoint came in 2% above analysts’ estimates. Its GAAP loss of $1.01 per share was 62.2% below analysts’ consensus estimates.

Is now the time to buy TPI Composites? Find out by accessing our full research report, it’s free.

TPI Composites (TPIC) Q1 CY2025 Highlights:

- Revenue: $336.2 million vs analyst estimates of $314.6 million (12.4% year-on-year growth, 6.9% beat)

- EPS (GAAP): -$1.01 vs analyst expectations of -$0.62 (62.2% miss)

- Adjusted EBITDA: -$10.3 million vs analyst estimates of $5.28 million (-3.1% margin, significant miss)

- The company reconfirmed its revenue guidance for the full year of $1.45 billion at the midpoint

- Operating Margin: -6.8%, up from -13% in the same quarter last year

- Free Cash Flow was -$1.89 million compared to -$47.29 million in the same quarter last year

- Market Capitalization: $41.42 million

”In the first quarter, TPI achieved 14% year-over-year growth in sales and drove positive cash flows from operating activities despite a challenging geopolitical and operating environment. The various economic challenges presented in the markets where we operate continue to create uncertainty in the industry’s near-term outlook and continue to challenge our operations. We are continuing to focus on maximizing value and ensuring that we have sufficient liquidity. Additionally, we are working with a committee of our Board of Directors and with advisors to conduct a strategic review of our business and evaluate potential strategic alternatives focused on optimizing our capital structure for the current and future environment,” said Bill Siwek, President and CEO of TPI Composites.

Company Overview

Founded in 1968, TPI Composites (NASDAQ:TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

Sales Growth

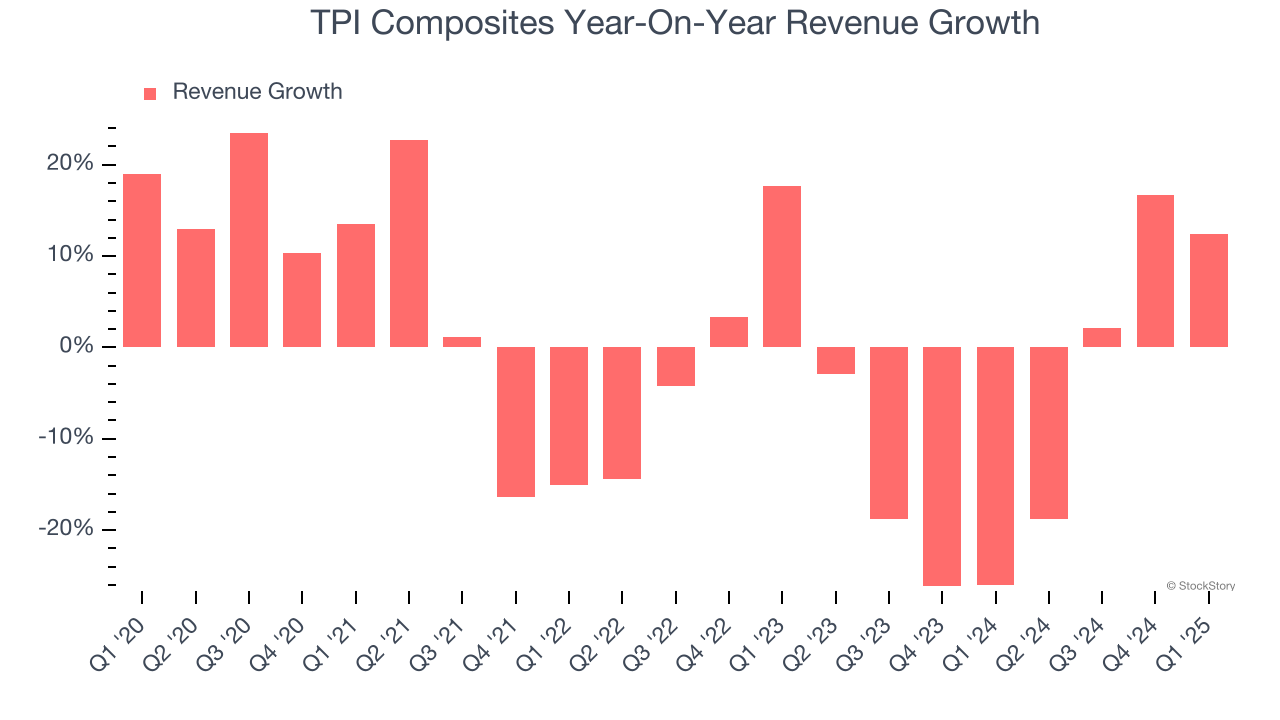

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. TPI Composites struggled to consistently generate demand over the last five years as its sales dropped at a 1.7% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. TPI Composites’s recent performance shows its demand remained suppressed as its revenue has declined by 9% annually over the last two years. TPI Composites isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, TPI Composites reported year-on-year revenue growth of 12.4%, and its $336.2 million of revenue exceeded Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

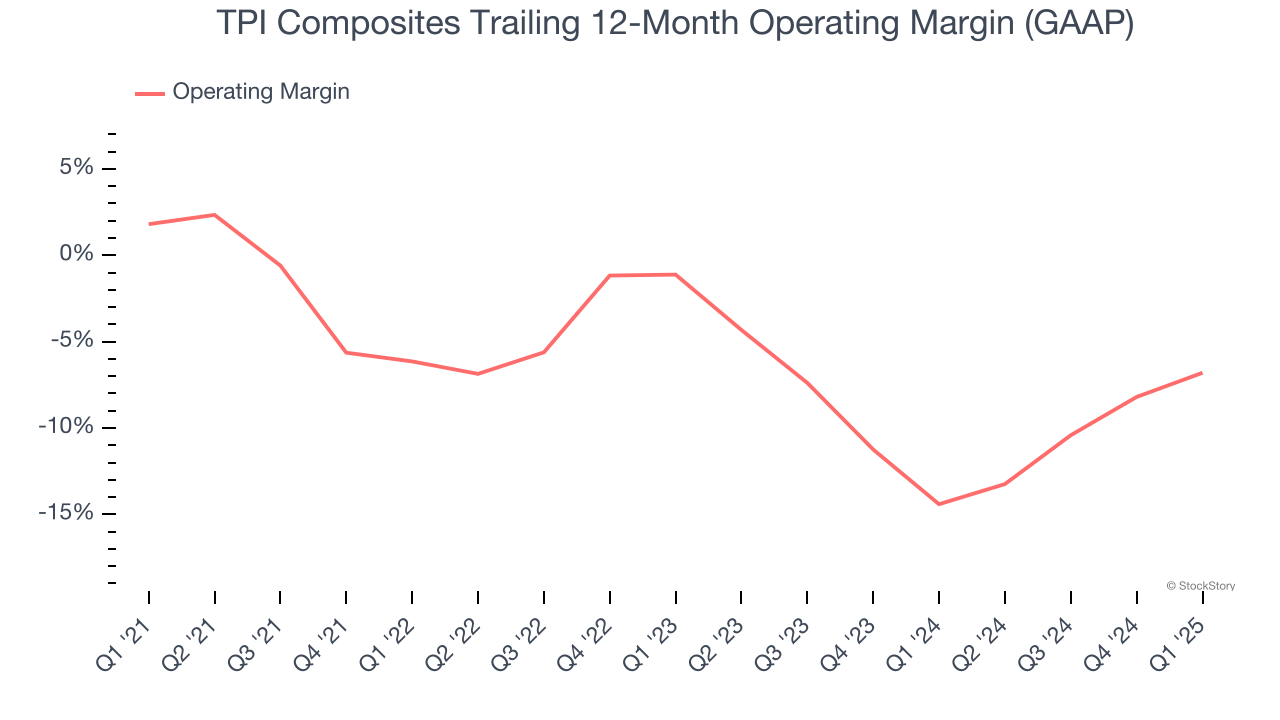

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

TPI Composites’s high expenses have contributed to an average operating margin of negative 4.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, TPI Composites’s operating margin decreased by 8.6 percentage points over the last five years. TPI Composites’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, TPI Composites generated a negative 6.8% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

TPI Composites’s earnings losses deepened over the last five years as its EPS dropped 104% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, TPI Composites’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For TPI Composites, its two-year annual EPS declines of 23.7% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q1, TPI Composites reported EPS at negative $1.01, up from negative $1.31 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects TPI Composites to improve its earnings losses. Analysts forecast its full-year EPS of negative $4.15 will advance to negative $1.70.

Key Takeaways from TPI Composites’s Q1 Results

We were impressed by how significantly TPI Composites blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA and EPS missed significantly. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 1.9% to $0.96 immediately following the results.

Big picture, is TPI Composites a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.