The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how professional tools and equipment stocks fared in Q1, starting with Stanley Black & Decker (NYSE:SWK).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 1.1% above.

In light of this news, share prices of the companies have held steady as they are up 3.7% on average since the latest earnings results.

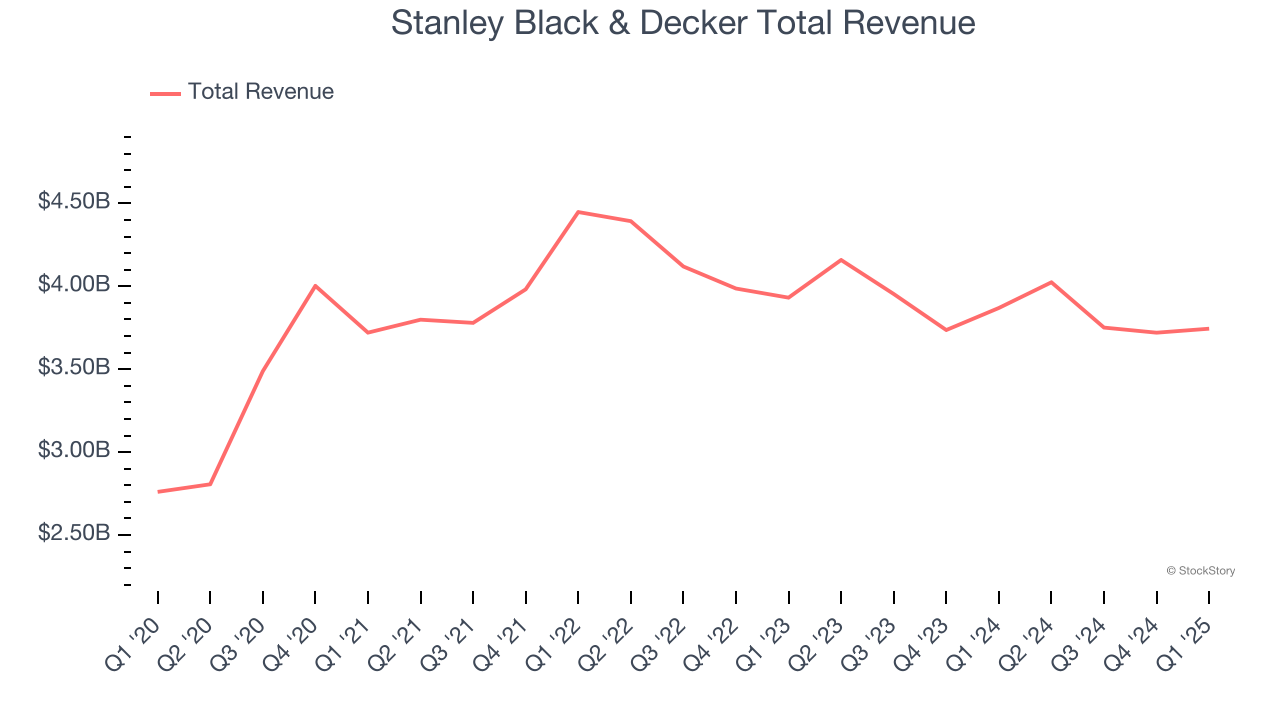

Stanley Black & Decker (NYSE:SWK)

With an iconic “STANLEY” logo which has remained virtually unchanged for over a century, Stanley Black & Decker (NYSE:SWK) is a manufacturer primarily catering to the tool and outdoor equipment industry.

Stanley Black & Decker reported revenues of $3.74 billion, down 3.2% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates.

The stock is up 7.1% since reporting and currently trades at $65.50.

Is now the time to buy Stanley Black & Decker? Access our full analysis of the earnings results here, it’s free.

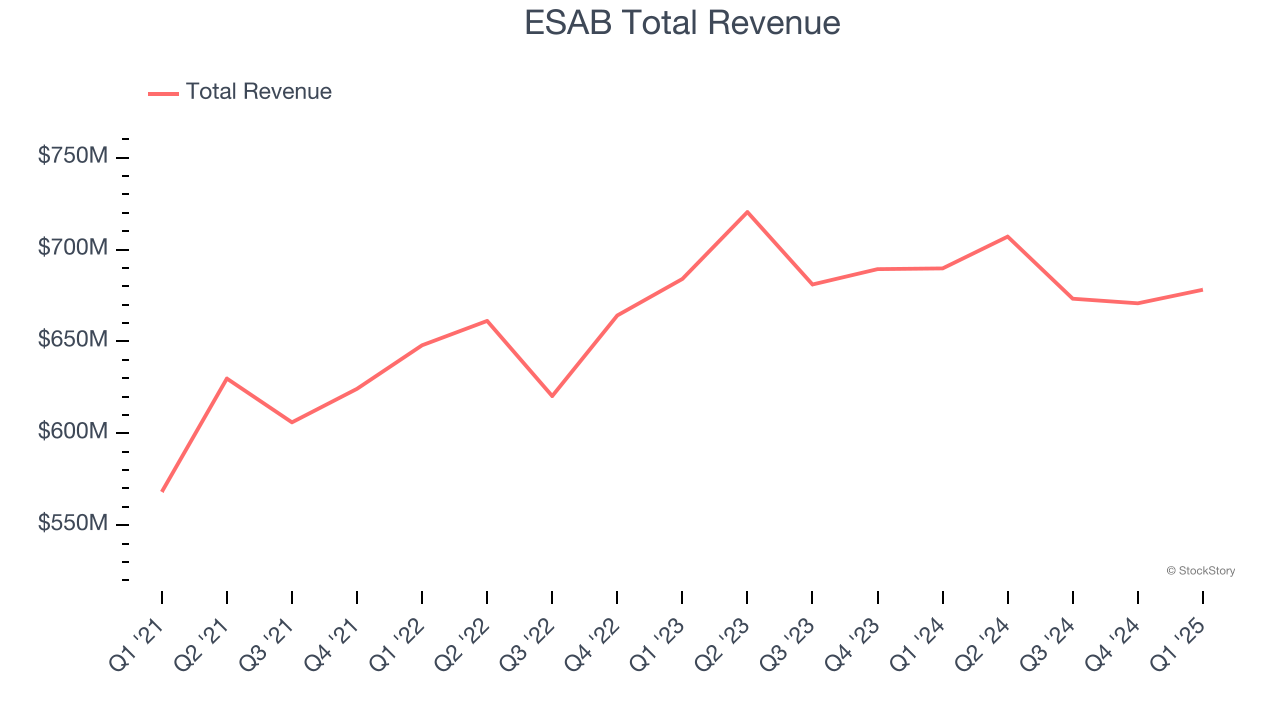

Best Q1: ESAB (NYSE:ESAB)

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB reported revenues of $678.1 million, down 1.7% year on year, outperforming analysts’ expectations by 2.2%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 3% since reporting. It currently trades at $123.74.

Is now the time to buy ESAB? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Snap-on (NYSE:SNA)

Founded in 1920, Snap-on (NYSE:SNA) is a global provider of tools, equipment, and diagnostics for various industries such as vehicle repair, aerospace, and the military.

Snap-on reported revenues of $1.24 billion, down 3% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Snap-on delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.9% since the results and currently trades at $312.34.

Read our full analysis of Snap-on’s results here.

Fortive (NYSE:FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

Fortive reported revenues of $1.47 billion, down 3.3% year on year. This number lagged analysts' expectations by 1.4%. Aside from that, it was a mixed quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is up 1.3% since reporting and currently trades at $70.50.

Read our full, actionable report on Fortive here, it’s free.

Nordson (NASDAQ:NDSN)

Founded in 1954, Nordson Corporation (NASDAQ:NDSN) manufactures dispensing equipment and industrial adhesives, sealants and coatings.

Nordson reported revenues of $682.9 million, up 5% year on year. This print beat analysts’ expectations by 1.1%. More broadly, it was a satisfactory quarter as it also produced EPS guidance for next quarter topping analysts’ expectations but organic revenue in line with analysts’ estimates.

Nordson pulled off the fastest revenue growth among its peers. The stock is up 12.4% since reporting and currently trades at $220.

Read our full, actionable report on Nordson here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.