The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Sally Beauty (NYSE:SBH) and the rest of the beauty and cosmetics retailer stocks fared in Q1.

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

The 4 beauty and cosmetics retailer stocks we track reported a mixed Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 9.5% on average since the latest earnings results.

Sally Beauty (NYSE:SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

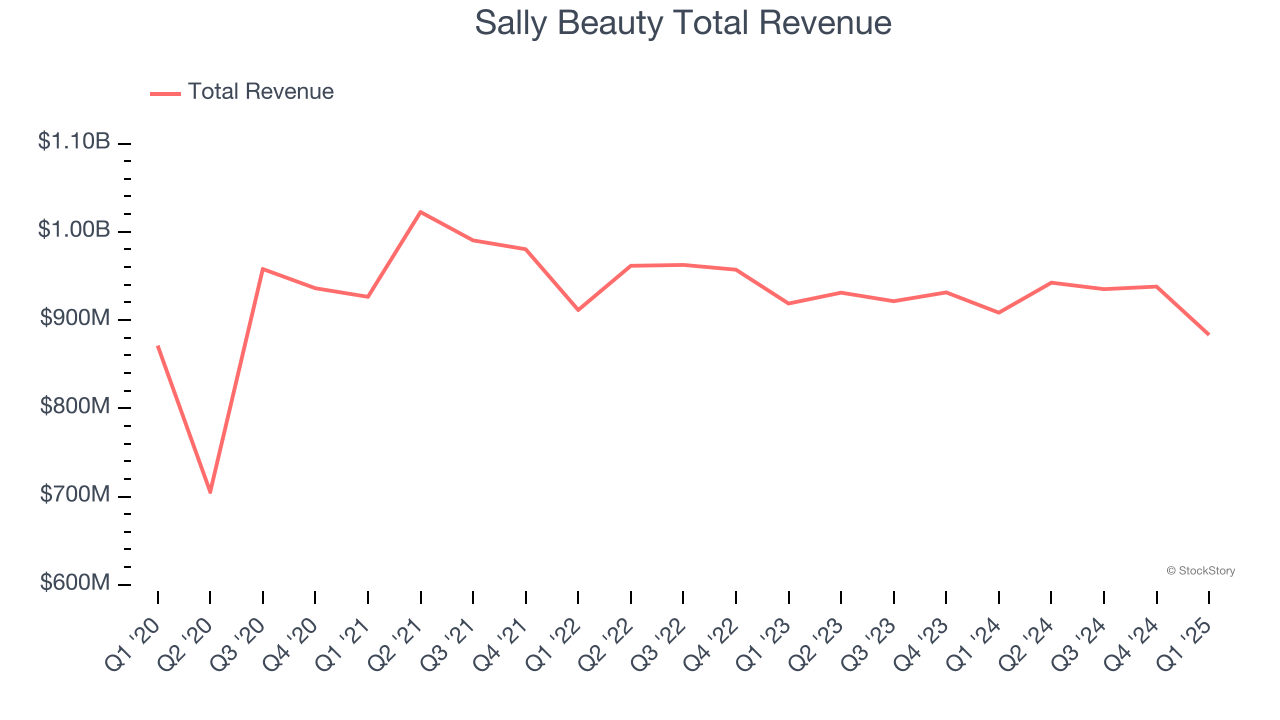

Sally Beauty reported revenues of $883.1 million, down 2.8% year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a mixed quarter for the company with a narrow beat of analysts’ gross margin estimates.

Sally Beauty delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 6.1% since reporting and currently trades at $8.67.

Is now the time to buy Sally Beauty? Access our full analysis of the earnings results here, it’s free.

Best Q1: Ulta (NASDAQ:ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

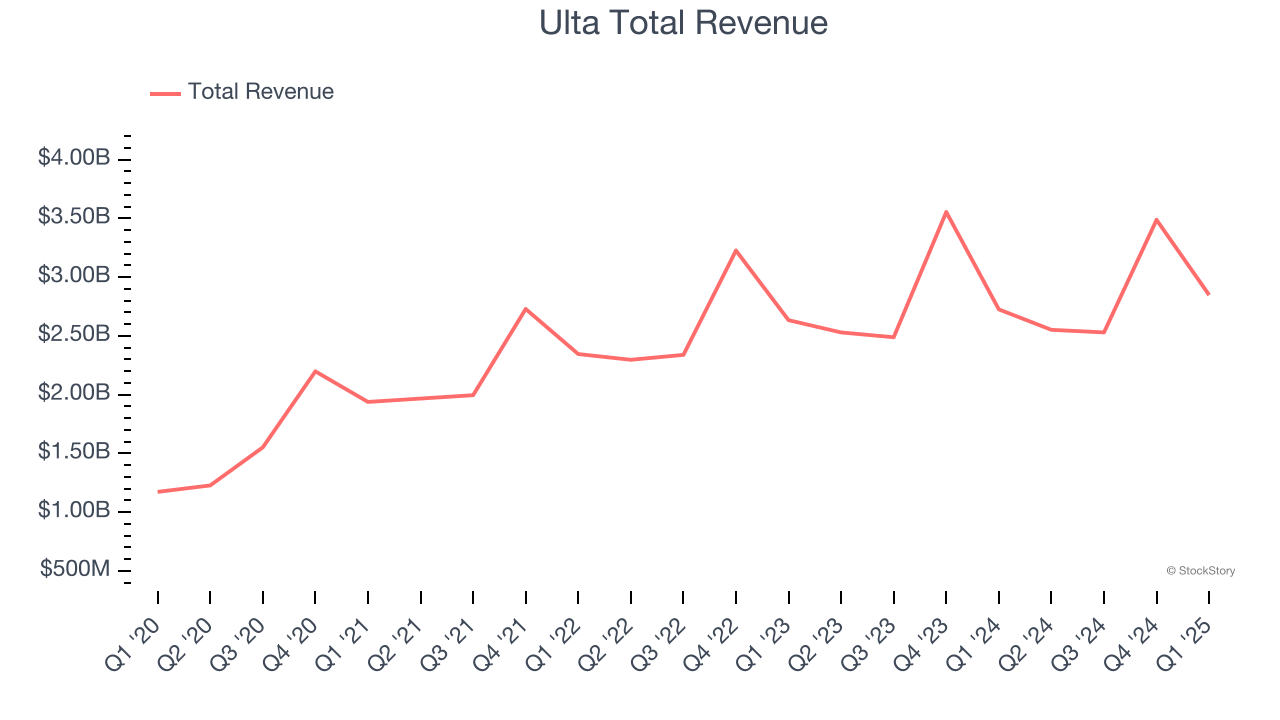

Ulta reported revenues of $2.85 billion, up 4.5% year on year, outperforming analysts’ expectations by 1.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

Ulta scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 10.7% since reporting. It currently trades at $467.38.

Is now the time to buy Ulta? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Bath and Body Works (NYSE:BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $1.42 billion, up 2.9% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 15.3% since the results and currently trades at $25.81.

Read our full analysis of Bath and Body Works’s results here.

Warby Parker (NYSE:WRBY)

Founded in 2010, Warby Parker (NYSE:WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Warby Parker reported revenues of $223.8 million, up 11.9% year on year. This print came in 0.8% below analysts' expectations. In spite of that, it was a strong quarter as it produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Warby Parker pulled off the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 36.3% since reporting and currently trades at $22.

Read our full, actionable report on Warby Parker here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.