Work management software maker Asana (NYSE: ASAN) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 8.6% year on year to $187.3 million. Guidance for next quarter’s revenue was better than expected at $193 million at the midpoint, 0.5% above analysts’ estimates. Its non-GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Asana? Find out by accessing our full research report, it’s free.

Asana (ASAN) Q1 CY2025 Highlights:

- Revenue: $187.3 million vs analyst estimates of $185.5 million (8.6% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.02 (significant beat)

- Adjusted Operating Income: $8.14 million vs analyst estimates of $2.70 million (4.3% margin, significant beat)

- The company reconfirmed its revenue guidance for the full year of $782.5 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $0.22 at the midpoint, a 12.8% increase

- Operating Margin: -23.4%, up from -38.4% in the same quarter last year

- Free Cash Flow Margin: 2.1%, down from 6.6% in the previous quarter

- Net Revenue Retention Rate: 95%

- Market Capitalization: $4.33 billion

Company Overview

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

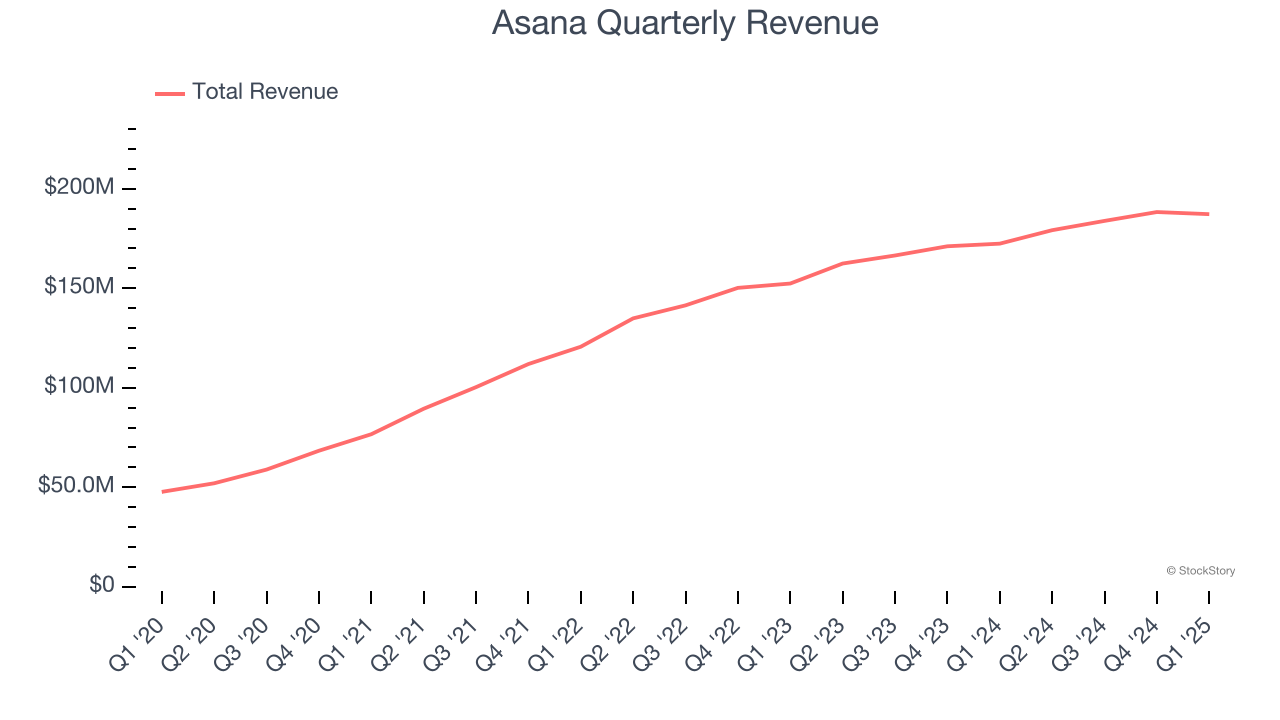

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Asana’s 20.5% annualized revenue growth over the last three years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Asana reported year-on-year revenue growth of 8.6%, and its $187.3 million of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 7.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

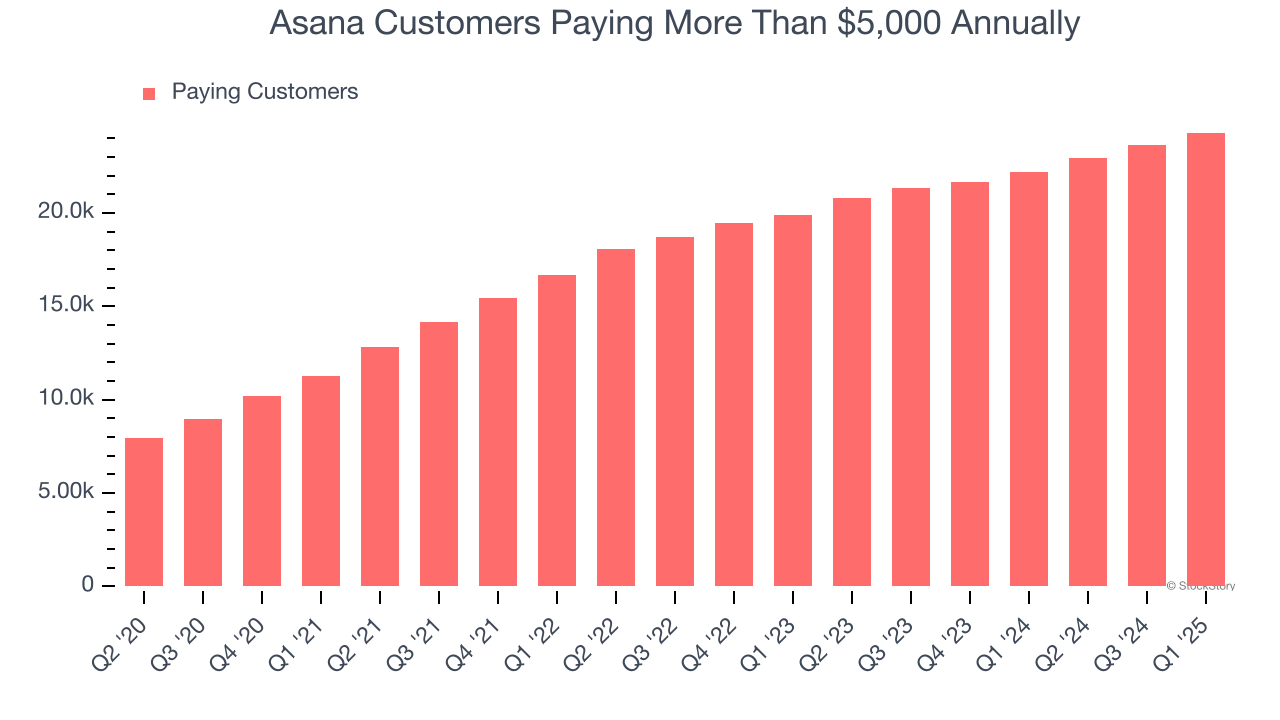

Enterprise Customer Base

This quarter, Asana reported 24,297 enterprise customers paying more than $5,000 annually,

Key Takeaways from Asana’s Q1 Results

We were glad to see Asana raise its full-year EPS guidance and beat analysts' revenue, EPS, and adjusted operating income expectations. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1.8% to $18.63 immediately after reporting.

Is Asana an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.