Diversified solutions provider Matthews International (NASDAQ:MATW) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales fell by 18.3% year on year to $349.4 million. Its non-GAAP profit of $0.28 per share was 30.2% above analysts’ consensus estimates.

Is now the time to buy Matthews? Find out by accessing our full research report, it’s free.

Matthews (MATW) Q2 CY2025 Highlights:

- Revenue: $349.4 million vs analyst estimates of $322 million (18.3% year-on-year decline, 8.5% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.22 (30.2% beat)

- Adjusted EBITDA: $44.6 million vs analyst estimates of $40.3 million (12.8% margin, 10.7% beat)

- EBITDA guidance for the full year is $190 million at the midpoint, above analyst estimates of $179.8 million

- Operating Margin: 21.5%, up from 1.5% in the same quarter last year

- Free Cash Flow was -$23.32 million, down from $4.35 million in the same quarter last year

- Market Capitalization: $746.4 million

Company Overview

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Revenue Growth

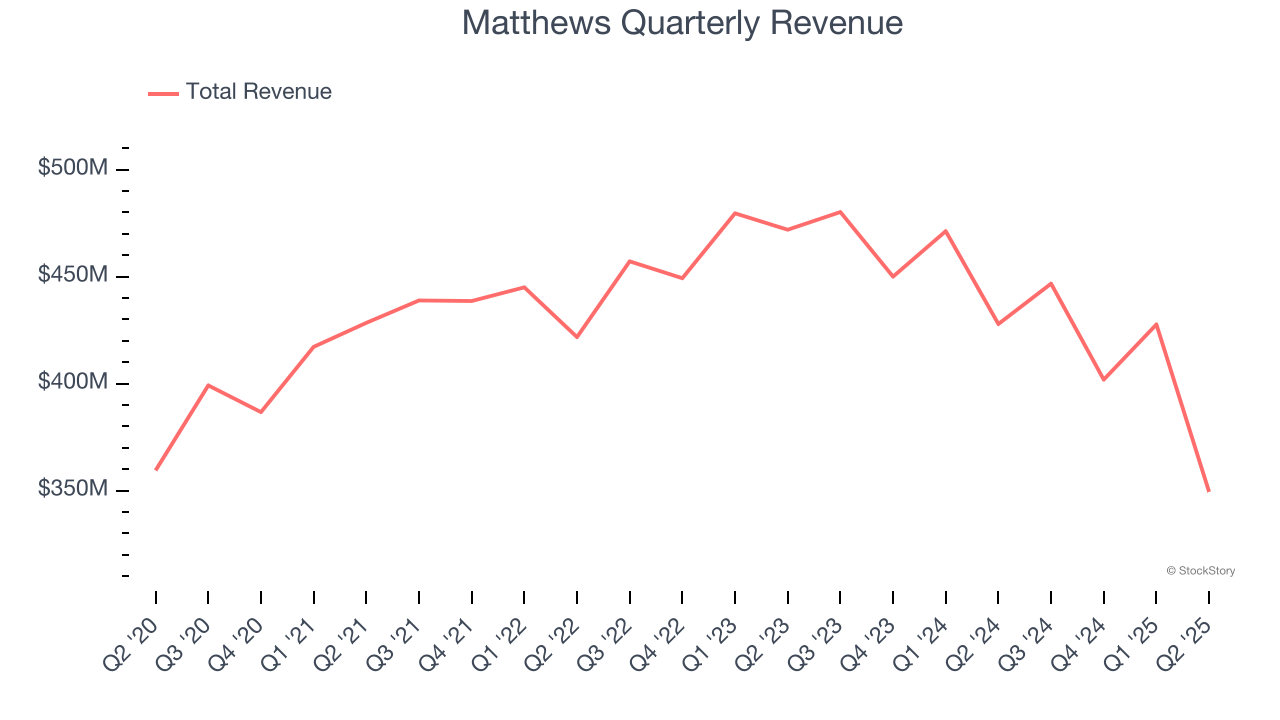

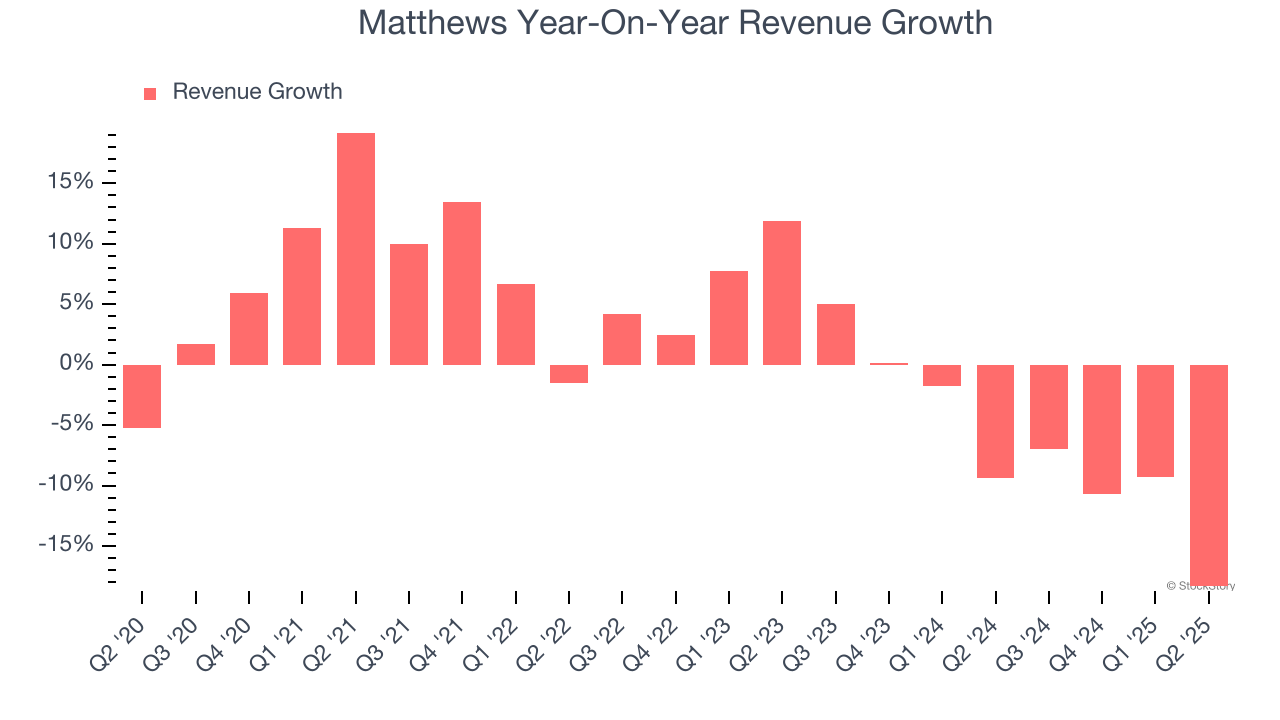

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Matthews’s sales grew at a weak 1.7% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Matthews’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.5% annually.

This quarter, Matthews’s revenue fell by 18.3% year on year to $349.4 million but beat Wall Street’s estimates by 8.5%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

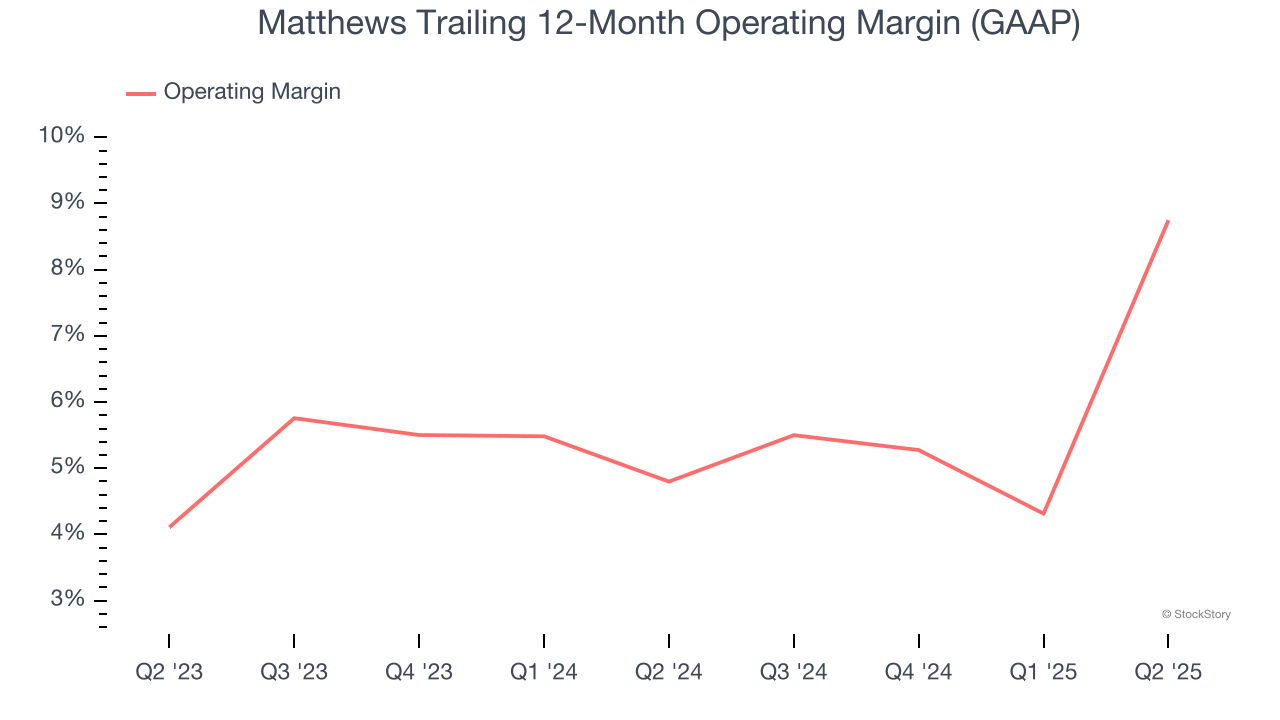

Matthews’s operating margin has been trending up over the last 12 months and averaged 6.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a consumer discretionary business.

In Q2, Matthews generated an operating margin profit margin of 21.5%, up 20 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

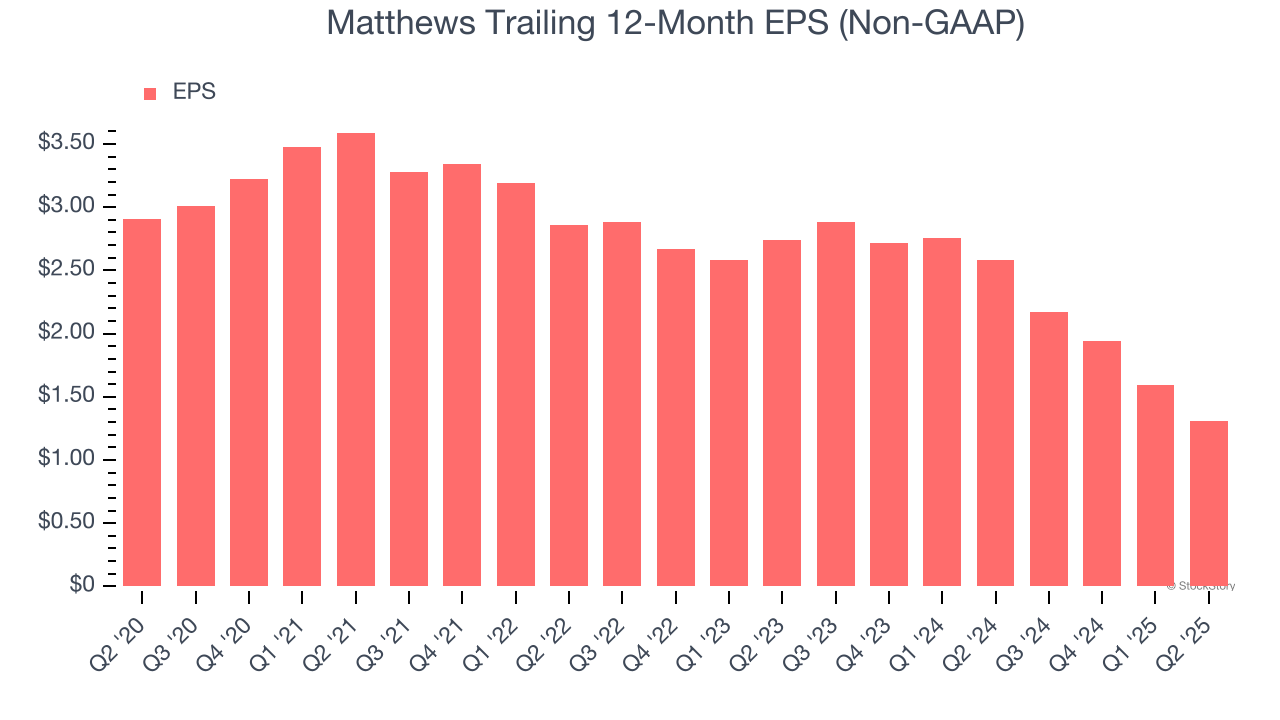

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Matthews, its EPS declined by 14.8% annually over the last five years while its revenue grew by 1.7%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q2, Matthews reported adjusted EPS at $0.28, down from $0.56 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Matthews’s Q2 Results

We were impressed by how significantly Matthews blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EBITDA guidance outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $24.07 immediately following the results.

Sure, Matthews had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.