Lennar Corp (LEN)

120.83

+0.00 (0.00%)

NYSE · Last Trade: Feb 13th, 9:00 AM EST

Detailed Quote

| Previous Close | 120.83 |

|---|---|

| Open | - |

| Bid | 119.85 |

| Ask | 122.18 |

| Day's Range | N/A - N/A |

| 52 Week Range | 98.42 - 144.24 |

| Volume | 1,430 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.000 (1.66%) |

| 1 Month Average Volume | 2,903,780 |

Chart

About Lennar Corp (LEN)

Lennar Corporation is a leading home construction and real estate development company that focuses on building and selling residential communities. The company operates across various segments, including single-family homes, multi-family homes, and commercial properties, catering to a diverse range of customers from first-time homebuyers to luxury home purchasers. In addition to construction, Lennar also provides financial services and mortgage brokerage solutions, facilitating home financing for its buyers. With a strong emphasis on sustainability and community development, the company strives to create innovative, quality living spaces that enhance the overall quality of life for its residents. Read More

News & Press Releases

The financial world experienced a seismic shift on January 30, 2026, when President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. This move, long-telegraphed by the administration but still jarring to global markets, marks the beginning of what analysts are calling the

Via MarketMinute · February 12, 2026

The U.S. labor market just delivered a thunderclap that has reverberated from the halls of the Federal Reserve to the trading floors of Wall Street. In a stunning reversal of the "cooling" narrative that dominated the final months of 2025, the January jobs report released this morning revealed that

Via MarketMinute · February 12, 2026

LEN, DHI Stocks Slip On Reports Of A Potential DOJ Probestocktwits.com

Via Stocktwits · February 6, 2026

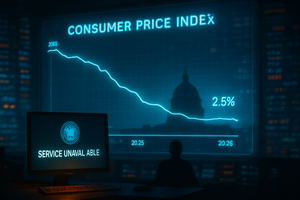

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

There is a homebuilding shortage in the United States, and it represents a powerful secular trend worth investing in

Via The Motley Fool · February 11, 2026

As of February 11, 2026, the American real estate market is grappling with a profound "regime change" in monetary policy. The recent nomination of Kevin Warsh as Chairman of the Federal Reserve has introduced a dual-track strategy that is sending shockwaves through the housing sector. While the central bank has

Via MarketMinute · February 11, 2026

The morning of February 11, 2026, marks the end of a grueling "data blackout" for Wall Street. After a partial government shutdown that began on January 30th paralyzed the Bureau of Labor Statistics (BLS), the highly anticipated January employment situation report has finally been released. The delay, while only five

Via MarketMinute · February 11, 2026

As the first quarter of 2026 gets underway, the American economic landscape is being fundamentally reshaped by the "One Big Beautiful Bill Act" (OBBBA). Signed into law by President Trump following a heated legislative battle in late 2025, the sweeping fiscal package has begun to filter through the pockets of

Via MarketMinute · February 11, 2026

The fact that few others like it right now only adds to its potential upside.

Via The Motley Fool · February 10, 2026

With the era of Jerome Powell rapidly approaching its sunset, the financial world is grappling with a potential "regime change" that could fundamentally alter the relationship between the Federal Reserve, the economy, and the stock market. The recent nomination of Kevin Warsh to succeed Powell as Chair of the Board

Via MarketMinute · February 9, 2026

In a move that has sent shockwaves through global financial markets, the nomination of Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve has signaled a dramatic regime shift in American monetary policy. Announced on January 30, 2026, the decision marks the end of the "Powell

Via MarketMinute · February 6, 2026

The global financial landscape has been sent into a whirlwind of speculation and strategic repricing following President Trump’s formal nomination of Kevin Warsh to succeed Jerome Powell as the next Chair of the Federal Reserve. Announced on January 30, 2026, the move marks a pivotal transition for the world’

Via MarketMinute · February 6, 2026

Lennar and other homebuilders are about to propose a home construction plan to the White House.

Via The Motley Fool · February 5, 2026

According to a Bloomberg report, the proposal aims to encourage home builders to construct homes under a plan that would allow people to transition from renting to owning.

Via Stocktwits · February 3, 2026

In a move that underscores the delicate balance of modern monetary policy, the Federal Reserve concluded its first meeting of 2026 on January 28 by electing to hold the federal funds rate steady at 3.50%–3.75%. This decision comes at a pivotal moment for the U.S. economy,

Via MarketMinute · February 2, 2026

Following a turbulent period of political gridlock and fiscal uncertainty, new data released by the U.S. Census Bureau on January 21, 2026, reveals that U.S. construction spending rose by 0.5% in October 2025. This increase brought the seasonally adjusted annual rate to $2.175 trillion, a figure

Via MarketMinute · January 30, 2026

The U.S. housing market faced a chilling end to 2025 as the National Association of Realtors (NAR) reported a staggering 9.3% plunge in pending home sales for December. This sharp month-over-month decline pushed contract signings to their lowest level since the onset of the COVID-19 pandemic in 2020,

Via MarketMinute · January 30, 2026

The Federal Reserve has officially entered a period of strategic observation, opting to hold interest rates steady following its first meeting of 2026. This decision, announced today, January 28, 2026, keeps the federal funds rate at a range of 3.50% to 3.75%. While the "pause" was widely anticipated,

Via MarketMinute · January 28, 2026

The sovereign bond market sent a clear signal to Washington and Wall Street this month as the benchmark 10-year Treasury yield surged to a multi-month high of 4.29% on January 20, 2026. This sharp move upward reflects a growing consensus among investors that the Federal Reserve may be physically

Via MarketMinute · January 26, 2026

As the first month of 2026 draws to a close, the narrative that dominated Wall Street for the better part of three years—the undisputed reign of mega-cap technology—is rapidly fracturing. In its place, a massive "sector rotation" is taking hold, fundamentally altering the landscape for institutional and retail

Via MarketMinute · January 22, 2026

As of January 22, 2026, the global fixed-income landscape is undergoing a period of intense recalibration. The benchmark U.S. 10-year Treasury yield surged this week, climbing to a peak of 4.30% on Tuesday before stabilizing at 4.26% today. This mark represents the highest level for the sovereign

Via MarketMinute · January 22, 2026

Berkshire Hathaway no longer owns this stock. But it appears to be a great pick after a recent decline.

Via The Motley Fool · January 22, 2026

The United States housing market entered 2026 on icy footing as newly released data for December 2025 reveals a staggering decline in pending home sales. According to the National Association of Realtors (NAR), contract signings dropped by 9.3% month-over-month, while competing data from Redfin (NASDAQ:RDFN) noted a 5.

Via MarketMinute · January 21, 2026

As the United States economy navigates the complex aftermath of a historic 43-day federal government shutdown and a shifting political landscape, the release of the December 2025 Consumer Price Index (CPI) has provided a critical, if somewhat ambiguous, roadmap for the year ahead. Data released on January 13, 2026, by

Via MarketMinute · January 21, 2026

In a week marked by high-stakes economic data releases, the U.S. bond market witnessed a significant shift as the benchmark 10-year Treasury yield retreated below the critical 4.15% level. This movement followed a "Goldilocks" combination of cooling inflation figures and unexpectedly resilient consumer spending, providing investors with a

Via MarketMinute · January 21, 2026