San Juan Basin Royalty Trust Common Stock (SJT)

5.4100

+0.0100 (0.19%)

NYSE · Last Trade: Feb 25th, 3:51 AM EST

Let’s dive into SAN JUAN BASIN ROYALTY TR (NYSE:SJT) using Peter Lynch’s key investing principles, from earnings growth and debt levels to long-term scalability and valuation.

Via Chartmill · March 21, 2025

San Juan Basin Royalty just reported results for the second quarter of 2024.

Via InvestorPlace · August 14, 2024

San Juan Basin Royalty just reported results for the first quarter of 2024.

Via InvestorPlace · May 14, 2024

JPMorgan CEO Jamie Dimon lashed out at the Biden administration's LNG export ban. These three natural gas stocks are caught in the crossfire.

Via InvestorPlace · April 16, 2024

Via Benzinga · October 25, 2023

If natural gas prices and royalties increase, so will the payments to investors. And if gas prices decline, the dividend will too. That makes San Juan Basin Royalty Trust's monthly dividend variable.

Via Talk Markets · June 10, 2023

San Juan Basin Royalty just reported results for the fourth quarter of 2023.

Via InvestorPlace · April 1, 2024

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

Via Benzinga · December 29, 2023

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

Via Benzinga · December 14, 2023

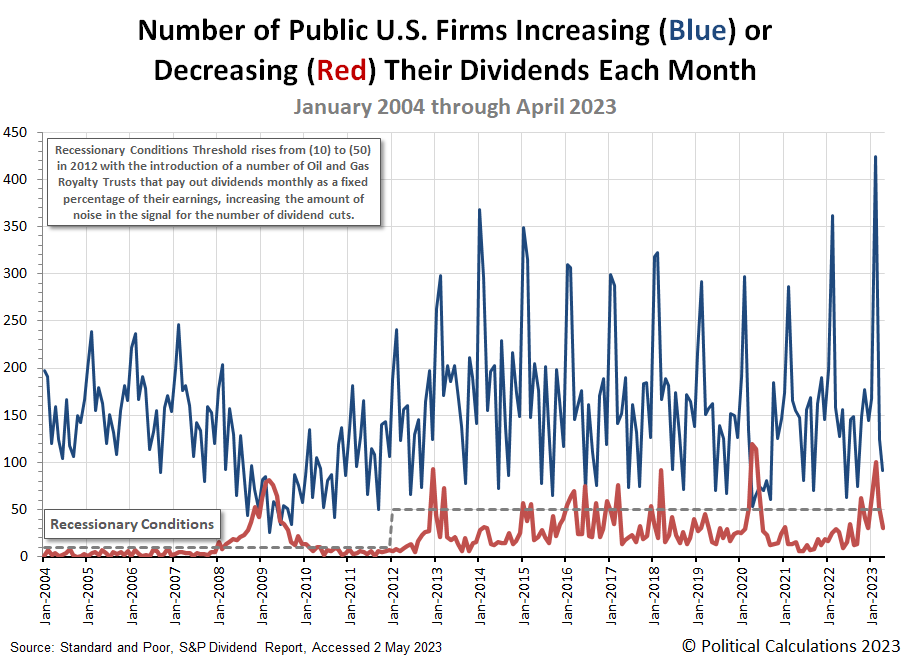

November 2023's dividend changes can be summarized pretty simply. Month-over-month, they were positive. Year-over-year, they were mixed.

Via Talk Markets · December 5, 2023

At first glance, October 2023's data for dividend changes looks like an improvement from September 2023. Month-over-month, the number of declared dividend increases rose and the number of dividend decreases fell, which is a positive development.

Via Talk Markets · November 2, 2023

Via Benzinga · September 25, 2023

Navigate the energy quagmire knowing which energy stocks to sell at this time to marginalize your portfolio risk

Via InvestorPlace · September 25, 2023

It's time for a crude reality check in determining which oil stocks to sell at this time, offering little upside ahead.

Via InvestorPlace · September 21, 2023

By the close of today, September 07, 2023, GeoPark (NYSE:GPRK) will issue a dividend payout of $0.13 per share, resulting in an annualized dividend yield of 5.43%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on August 23, 2023.

Via Benzinga · September 7, 2023

By the close of today, August 30, 2023, North European Oil (NYSE:NRT) will issue a dividend payout of $0.21 per share, resulting in an annualized dividend yield of 5.61%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on August 17, 2023.

Via Benzinga · August 30, 2023

June 2023 marked the end of a mixed quarter for dividend paying stocks in the U.S. stock market.

Via Talk Markets · July 5, 2023

Growth stocks are often outstanding investments, but they become even more appealing when you combine them with monthly dividends.

Via InvestorPlace · June 23, 2023

For investors seeking a regular monthly income stream, investing in these monthly dividend stocks will provide a consistent source of money.

Via InvestorPlace · May 4, 2023

Signs of distress continued to build in the U.S. stock market in April 2023. The number of firms increasing their dividends fell substantially during the month.

Via Talk Markets · May 3, 2023